11 Herbs and Spices: QA, Dev-Ops and Competitive Advantage

What’s in FISPAN’s secret sauce? Our Automated Quality Program.

At FISPAN, we embed financial services to work seamlessly within clients’ ERPs. When we created FISPAN, we received the same questions from investors and banks alike, “What is your special sauce?” or “What is stopping the banks from doing this themselves?”. The idea behind FISPAN wasn’t new but it had never been cracked, it was fair for those investors and banks to ask, “What makes this possible now versus when we tried 5, 10 or 20 years ago?”

From my perspective the answers to those questions are simple.

- Point2Point connections between a bank and any given ERP tend to be brittle, they really require a platform in the middle to abstract the complexities of the bank from the ERPs and vise-versa.

- The complexity of this kind of bank system to the client system network grows exponentially. The periodicity of the changes to each endpoint system requires frequent and seamless releases to the platform and the rate of change demands a powerful and proactive Quality Automation.

A huge part of FISPAN’s secret sauce is our Automated Quality Program, but how does our Quality Program work?

Dev-Ops A Quick Refresher

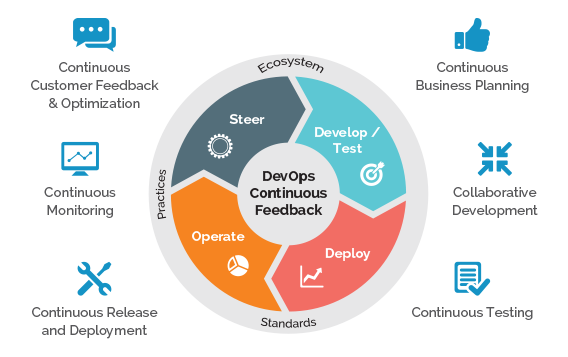

Continuous Integration, Testing, Deployment and Continuous Monitoring

While Dev-Ops originated as principles about how to minimize friction between application development and IT operations, in recent years it is often a shorthand for referring to the high degree of automation along the whole development life cycle including integration, deployments, provisioning, testing and monitoring.

As a young company, FISPAN’s platform was born completely within this paradigm on day one meaning that some of our first lines of code were not functional, however, focused on building some of the CI/CD toolings that we still use today.

Quality At FISPAN

Back to our secret sauce, the FISPAN platform is connected to various endpoint application systems. Historically this is exactly the kind of system where a team loses faith in new releases and tends towards an annual release cycle, with a frenzied manual Quality Assurance (QA) effort pre-release, this is not true at FISPAN. In our world the quality program is automated, allowing us to find errors at code commit and not at release and the confidence to release daily.

It is sometimes said that an infinite number of monkeys, typing on an infinite amount of keyboards will eventually create the works of Shakespeare. Certainly, some software development operations treat QA the same way, having an army of humans clicking and scripting their way through each new release however we believe that automation is the way forward.

Our Automated Validation path:

Best practice: Your code - your tests! Our developers add baseline tests before releasing features, so by the time QA comes in - only slight polishing is required. And before changes reach a “live” environment it’s covered with tests.

The above process isn’t the only thing that supports our quality. At the same time, the platform is validated for its performance with many tests and supported with a dedicated test suite, to validate platform throughput capabilities. All of it is monitored with alerts in-place for excessive resources consumption or overloads to be handled timely.

Once all results are in place changes can be deployed to production, without interruption of current services.

This process gives us confidence in the releases process that we tend to release weekly. More importantly, the regular E2E testing allows us to catch errors from both the bank and our ERP partners oftentimes unreported changes around their releases allowing us to adapt on our end to prevent client-facing errors.

The automated quality program at FISPAN is a massive insurance policy on delivering our value proposition to the bank and more importantly to the bank’s customers. But in addition, it is part of our secret sauce and something that works best when built natively into the DNA of our platform and the DNA of our teams.