A Seat at the Table: How Corporate Treasurers Can Drive Strategy

Tasked with managing a firm’s financial wellbeing, the role of a Corporate Treasurer has evolved amidst changing global regulations, environments, and innovation. As the Treasurer’s list of opportunities and responsibilities grows, so do the complexities. To meet their evolving needs and expectations, corporate treasurers must be tactical and forward-thinking. With a strong understanding of the evolving business landscape, corporate treasurers are poised to play an increasingly strategic role in their organizations.

The Role of a Corporate Treasurer

Corporate Treasury has always been a role which required careful cash management and risk control. Corporate treasurers oversee that their company has the appropriate resources to respond to financial obligations at the right time, and in the right currency. With careful cash and liquidity management, their roles certify that organizations have the funds required to stay in business.

Corporate Treasury has always been a role which required careful cash management and risk control. Corporate treasurers oversee that their company has the appropriate resources to respond to financial obligations at the right time, and in the right currency. With careful cash and liquidity management, their roles certify that organizations have the funds required to stay in business.

Corporate treasurers are key to successfully navigating change. With a comprehensive understanding of the organization’s financial wellbeing and risk profile, they’re armed with the tools to support their team’s growth.

The role of a Corporate Treasurer is increasingly complex and important to an organization. It comprises a variety of responsibilities, including, but not limited to:

- Cash Management: Collect and manage cash flows and other short-term assets

- Risk Management: Ensure the organization can meet its financial obligations and assess the company’s risk profile.

- AP/AR: Manage Accounts Receivable (AR) and Accounts Payable (AP), ensuring sums owed to and required from third parties are handled

- Bank-Relationship Management: Maintain relationships with bank partners and other external parties

- Foreign Exchange (FX): While assessing currency exchanges, manage funds across international borders

- Reconciliation: Compare bank statements and Accounting books to check that data is correct

Economic Crises & The Treasurer’s Role

The increasingly strategic nature of a Corporate Treasurer’s role demands careful attention to global events and business disruptions. Some of these disruptions include fluctuating interest rates, geopolitical tensions, economic issues, and financial regulations, to name a few. Corporate treasurers must have a strong understanding of the changing business landscape in order to respond to the needs of their firm.

The increasingly strategic nature of a Corporate Treasurer’s role demands careful attention to global events and business disruptions. Some of these disruptions include fluctuating interest rates, geopolitical tensions, economic issues, and financial regulations, to name a few. Corporate treasurers must have a strong understanding of the changing business landscape in order to respond to the needs of their firm.

The financial crisis of 2008 was an important contributor in the evolution of Corporate Treasury as the economic crash reinforced the importance of liquidity and financial risk management. Alongside the introduction of new regulatory requirements in that time, corporates struggled to access financing. The ability to secure liquidity and manage a company’s risk profile came to the forefront, as did the strategic importance of corporate treasurers.

More recently, disruptions and volatility caused by the COVID-19 pandemic have demonstrated the comprehensive nature and demands of a corporate treasurer. From navigating workforce changes, supply chain disruptions, reduced sales and cash flow, operational fragility, concerns for remote access to treasury systems, and pressing laws and regulations, corporate treasurers continue to have a lot on their plate.

Additionally, fraud prevention and security challenges like phishing are an ever-present threat for corporate treasurers and CFOs. Treasury functions are becoming increasingly digital based, and fraudsters’ malicious tactics are becoming increasingly sophisticated alongside this evolution. Treasurers play an important role here in mitigating cybersecurity concerns by continuously managing a firm’s risk profile and cash flows.

As the Corporate Treasurer’s responsibilities continue to expand, it’s crucial that they leverage changing technology and trends to drive strategic value at their firms while protecting their company's best interests.

Embracing Strategic Opportunities for Corporate Treasury

The era of manual treasury management is over. Corporate treasurers must be poised to integrate new technologies and trends into their roles. Rapid innovation as seen in FinTech plays a huge role in advancing treasury management processes, while streamlining processes and increasing the efficiency of corporate treasurers. As more and more transformation continues to hit the financial landscape, corporate treasurers should move quickly to take advantage of the shift.

Staying on top of trends like cloud software, open banking, big data, automation, and artificial intelligence are critical for corporate treasurers to chart a successful path for their organization:

Staying on top of trends like cloud software, open banking, big data, automation, and artificial intelligence are critical for corporate treasurers to chart a successful path for their organization:

- Big data: Big data continues to dominate industries as it enables enhanced insights into operational and financial performance. Leaders can discover new ways to parse through large amounts of data to identify efficiencies and opportunities. The purpose of big data for analytics is not just simply analyzing past business performance, but an increasingly forward-looking business function that aims to predict future trends, like market volatility.

- Open Banking: By authorizing the secure exchange of data between financial institutions and third parties, Open Banking allows consumers to access enhanced banking services. For corporate treasurers, Open Banking presents opportunities for integrated banking services between their commercial banks and FinTechs (like FISPAN).

- Cloud software: As teams continue to operate in remote and hybrid environments, cloud-based software solutions are key to remaining nimble amidst business disruption. Accessible in any location (with internet connection), cloud-based solutions such as ERP software enable financial professionals to view consolidated information and collaborate remotely.

- Automation: With so many digital technology opportunities, one of the last things financial professionals should be bogged down by are manual processes. Manual processes expose vulnerabilities for human error, are time consuming, and deflect from high value tasks. By automating their core business processes, corporate treasurers are better poised to handle their firm’s day-to-day functions and focus on strategic operations. FISPAN’s Head of Product Strategy, Matt Naish, noted in a recent article about digital banking and advanced technologies such as APIs, “...humans can be left to tackle the value-added activities [...] not processing paperwork that should be easily handled by digitization”.

ERPs and Corporate Treasury

It’s difficult to find a growing organization not using an Enterprise Resource Planning (ERP) or accounting system. As just about half of companies are moving towards acquiring or upgrading an ERP system, ERPs have proven to be an increasingly essential tool for a treasurer’s cross-functional collaboration. The ability to draw and consolidate information from other departments in a central system is helpful to paint a picture of the organization’s financial wellbeing. In a survey, increased collaboration and centralized enterprise-wide data were noted as two of the top three benefits businesses gained from using an ERP.

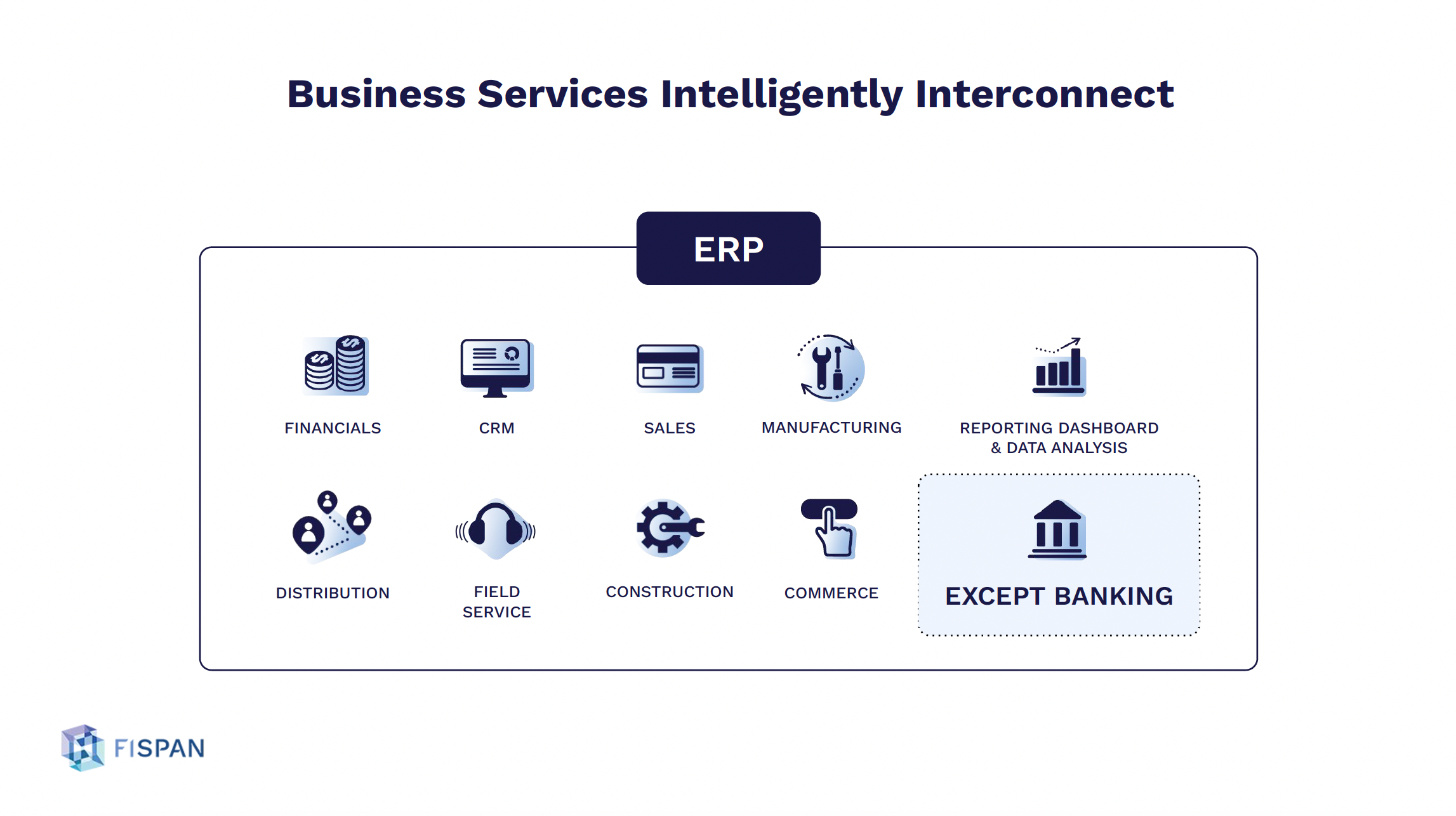

With an expanded list of responsibilities and a more strategic seat at the table, financial professionals count on their ERP system to increase efficiency and automate their treasury functions. Acting as a central hub for core operations such as supply chain, manufacturing, financials, accounting, and sales, ERPs host most core functions, except banking capabilities. Corporate treasurers must navigate between their banking portal and ERP system to complete their treasury management processes. Working between multiple portals can quickly become time consuming, increase the chances of human error, and divert the Treasurer’s focus away from high-value operations. This has been a point of contention in the Accounting field known as ‘swivel chair accounting’.

How FinTechs Like FISPAN Elevate the Corporate Treasurer’s Role

FISPAN works with top U.S. banks to seamlessly embed commercial banking services into the place you do business — your ERP. Through secure, two-way connectivity, APIs transform and translate your necessary financial data, allowing you to perform your treasury management functions all in one portal. Automate your payables, streamline your reconciliation, settle bill payments for foreign exchange (FX), and more right from your ERP environment. Top ERP providers like Sage Intacct and NetSuite partner with FISPAN to create an immersive, embedded banking experience and to allow you to focus on the tasks that matter most.

—

Learn more about how you can instantly transform your treasury management service, while saving time, money, and focusing on high-value, strategic operations. By taking advantage of embedded banking products, you can easily generate forward momentum in the shift to becoming more digital and strategic.