How Cloud-Based Platforms Can help CFOs Operate Remote Teams

Choosing cloud-based platforms for your business can mean the difference between major disruption to your financial operations and smoother sailing in the months ahead. As offices continue to walk the line between remote and hybrid office structures, cloud-based platforms form the future of modern work.

CFOs, as with any C-suite role, have always had their organizational struggles. Sourcing and maintaining top talent, staying on top of cash flow management and obtaining critical financial information in real time - just to name a few. Add to that the recent (ongoing?) Covid-19 pandemic and there’s no doubt CFOs had to scramble to figure out how to keep their accounting and finance functions operating as the corporate world shifted quickly to a remote work environment. Today, the pandemic has resulted in this “new norm” of working from home, with 58% of US job holders (equivalent to 92 million people) saying they can and want to continue working remotely at least part of the time. Like it or not, remote work, in some shape or form, is here to stay and for accounting & finance departments, it falls to the CFO to make it work and still achieve organizational goals.

Accounting teams have always leaned towards more traditional practices, but the pandemic has exacerbated the current issues that these teams might be facing, including a lack of accessibility and efficiency. In a 2021 Business Wire Report, 69% of executives stated that their employees lose paper documents, with 65% suggesting that these pen-and-paper processes reduce employee productivity.

As remote work continues to expand, cloud-based solutions can hold the answer for remote operating issues, both for businesses and the financial institutions they work with.

Enter Cloud-Based Solutions

While many companies dropped their on-premises programs and have adopted cloud technology, numerous operations continue to use old software. In many cases, these programs can only be used at the office or with a VPN, something not all employees may have. If IT departments are required to stay home, updates to mission-critical software may not happen and issues might not get resolved.

Cloud-based platforms, such as enterprise resource planning (ERP) software, can make life easier for CFOs more generally, too. ERP software forms a centralized platform and software where all company information is integrated, creating more productive and efficient workflows. Our own research has found that CFOs are frustrated with manual processes – many still use spreadsheets or they have to email their banks with payroll information rather than auto-uploading. Many also find that their old ERP systems don’t communicate with their banks properly, while forecasting and reconciliations are difficult to do.

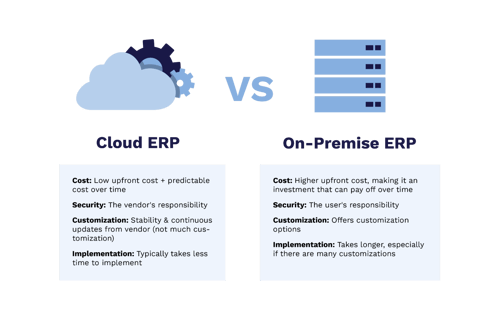

Here’s one way where integrating a cloud-based ERP can help your accounting team operate remotely. Cloud-based ERPs are accessed through the web and are hosted on the vendor’s server, whereas on-premise ERPs are installed locally, which means that they are installed directly to a company’s servers.

While Cloud ERPs allow companies to access and analyze large amounts of data with easy accessibility, on-premise ERPs allow companies the advantage of greater customization. In 2022, global cloud app spending will reach $226.9 billion, while cloud platform services will reach $70 billion.

Access Anywhere

One of the main benefits of the cloud is that it can be accessed anywhere and by anyone, including from a home office, which if you’re working remotely, is probably where you spend most of your time! That means your accounting team can quickly source invoices, account statements, purchase orders and forms at all times and from any location, as long as they have Wi-Fi. Contrary to paper-based processes, adopting a cloud-based platform allows your teams to store large amounts of documents in the cloud with limited risks, as it can be regularly backed up.

As well, a cloud-based ERP is also better equipped at generating data-related insights – it can easily tap into other cloud programs, like human capital management software, for instance – while many of those cumbersome manual processes can be done automatically and in real-time.

Remote Collaboration

Storing everything in an online database, such as a Cloud ERP, can greatly help your accounting team operate remotely and collaborate with one another no matter where they are located. This greatly differs from traditional practices that are characterized by physical desktops and hard drives.

As more companies adopt fully remote work structures, cloud-based platforms will play a big role in the ability to collaborate effectively. A study found that 1 in 2 people won’t return to jobs that fail to offer remote work, and legacy systems don’t offer the flexibility for remote work options.

Rethinking Tech

Rethinking Tech

With the popularity of remote work showing no sign of slowing down,, it’s important to reevaluate your company’s financial future as your company continues to adapt to the pandemic’s impact on cash flows and balance sheets. You’ll also be evaluating the effects of lost productivity and how working offsite will affect your operations.

Working in the cloud can make all of that easier to do. While it does take some time to ramp this tech up if you haven’t used it before, now may be the right moment to start looking into it, especially if you have more time on your hands.

You’ll also want to talk to your bank to see if they’re set up to communicate with a cloud-based ERP system. Unfortunately, many are not, but there are third-party companies, like FISPAN, that can help your ERP software speak to the bank’s programs and make transactions, such as payroll, easy to accomplish.

___

While there are some costs with going to the cloud, in the long term, using this software is cheaper than maintaining on-premises programs, which is another benefit in this kind of environment. Companies need to continue to adapt to changing environments – and there’s no better time than the present to reevaluate your financial software needs.

Are you a CFO or accounting manager looking to future-proof your team and streamline your treasury management workflow? Ask us about how we can help.