How To Choose a Bank That Can Help Boost Your Bottom Line

Updated August 8, 2022

Not all banks are created equal. Forward thinking banks that embrace next generation digital solutions are the ones that can help your business save time, increase operational savings and increase your overall revenue. Read on to learn about the top 3 things to consider when choosing (or re-evaluating) your business bank.

There is no relationship in business more important than the one with your bank. If you require funds for a capital investment, your first move would be to go to your financial institution for a loan, at hopefully a favourable rate. Moreover, your relationship with your bank doesn’t stop at loans, but can extend to other areas of your business as well. When it comes time to pay suppliers or staff, the right bank can make that process run smoothly. The wrong bank can make completing even the simplest transactions a virtual nightmare. Showcasing why having the right financial partner will not only give you peace of mind, but working with someone who cares about your success will also make it easier to take more risks – and, ultimately, increase your bottom line.

Business banking takes on two different forms, commercial or corporate banking, and most banks have both options.

Commercial banking primarily involves individuals and small business owners, and conducts activities such as merchant services, commercial loans, and treasury services.

Corporate banking mostly caters to large corporations and includes offerings such as credit, cash, and asset management.

When you look for a bank, you should look for one that has the right set of services at the right price to help move your business forward.

Choosing the right bank, however, isn’t as easy as it may seem. On the surface, many institutions look the same – they offer business bank accounts, usually comparable interest rates, access to online banking, bill payments and more. Finding the best partner – one that can help you make money, rather than lose it – will require you to dig deeper and look at how they’re using technology to help their customers grow. Here are three things to think about when choosing a bank.

1. Is it forward thinking?

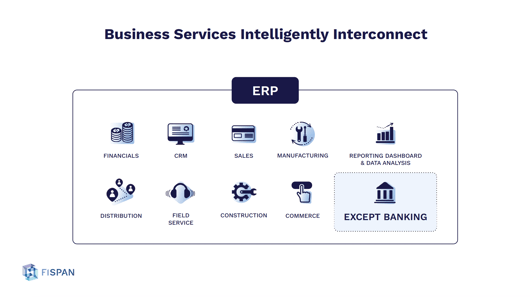

Too many financial institutions are still stuck in the past. While they may have online banking, that’s about all they have. Embracing new technologies is no longer optional, with 57% of small-business owners saying they will not do business with an institution that fails to offer online account opening. While some banks may allow you to send payments from your bank account to a vendor’s account, they might not allow you to send those same payments through your own enterprise resource planning (ERP) system, a centralized platform that integrates all company information together. Look to see if your bank offers an ERP banking solution, which would make the payment process that much more efficient. To get a better sense of how tech friendly a bank is, it’s important to consider the following questions.

- Is the bank trying out new technologies?

- Is it working with FinTechs to offer new and innovative services? (A fintech partnership between FISPAN and JPMorgan Chase has greatly helped to solve the most pressing issues in treasury management, learn more here)

- Is it investing in coders to help bolster its own services? (Bank of America, BNY Mellon and Citi have recently invested $20 million into the low-code platform, Genesis Global in 2022)

If the answer to these questions is no, then you may find it more difficult to do business with them in the future as your own business scales upwards.

2. Does your bank’s software talk to yours?

One constant headache for companies is having to use multiple systems to pay vendors. If your ERP system could talk to your bank, then making payments would be a lot easier. JPMorgan Chase figured this out – it offers a service called Treasury Ignition, which is an end-to-end wholesale payments experience. In collaboration with FISPAN, a NetSuite plugin was built that allows companies to pay vendors directly through their ERP system, giving clients the options on how they’d like to pay, whether it’s by ACH, wire or check. Status and balances are updated in real time, while a detailed history makes it easy to keep track of what’s been done. Having these two sides talk to each other can help executives run their businesses much more efficiently.

With your banking experience directly within your ERP and accounting software systems, treasury management functions and the payables process can be simplified. See how FISPAN’s embedded solution has integrated with Sage Intacct to create an immersive embedded banking experience.

3. Are they in the cloud?

Almost every industry is moving toward the cloud, except for one: banking. According to a 2022 Nutanix Survey, fewer financial services organizations have adopted multicloud than any other industry surveyed, trailing the global average by 10%. The ones that will meet your future needs will have to be more virtual, at least in some capacity, or else get left behind as expanded upon in our most popular whitepaper “Why Banks Must Embrace The Cloud or Risk Being Left Behind”.

With tighter competition from neo-banks and other financial services providers, banks need to put a greater focus on forward thinking technology and innovation to remain competitive and to protect themselves against losing customers.

Most of the programs you use today are cloud-based, which means your software provider can issue new features or update glitches in real time. Banks, on the other hand, can take forever to push out an innovation. With technology changing so rapidly, and business happening at breakneck speeds, having to wait for an improvement is not something many people are willing to do. Look for a bank that has at least some of its processes and programs in the cloud, so that they can keep up with your business’s changing needs.

The Bottom Line For Your Bottom Line

While there are many other factors to consider when it comes to choosing the right bank - in this growing digital age how a bank approaches technology should be a big determinant in who your organization chooses to work with. Banks and Financial Institutions that are tech savvy will be best positioned to help you improve upon antiquated processes, increase efficiencies in your business practices, keep your organization growing in the long term, and help improve your bottom line.

As your organization continues to scale, find out how you can better your commercial banking experience with FISPAN’s embedded banking solution. Book a demo today.