Journey to the Center of the Earth: Digital Treasury and You

When was the last time you physically attended a bank branch? Perhaps to obtain immediate funds availability for a check deposit, to replace a lost card or security token, or because your business’s signing officers changed.

What these examples have in common is that they are infrequent, require heightened identity and authority vetting, and may require assistance from bank personnel with specialized systems or process knowledge.

Since most day to day transactional activities are carried out via online banking, the physical bank branch acts as a manual transaction backup channel, a service escalation point, and a security/control center.

Many banks are investing in their treasury portals part of the staggering $1 Trillion banks are spending on digital each year. Soon, even infrequent business activities will be available as self-service components of online banking (e.g. stop-payments, bank drafts, personnel management). This is progress. It means a business client doesn’t need to interrupt their workflow, physically walk to the bank, wait in a queue, and conduct a branch transaction that could be more efficiently delivered digitally via online banking.

But it is only partial progress. The promise of APIs and embedded banking goes further. It means the business client doesn’t need to interrupt her workflow, login to the bank’s treasury portal, and conduct a transaction that could be more efficiently delivered interwoven with her business process itself.

The Impact of APIs & Third Party Apps on Banking

The point-of-service for common actions like making payments and viewing balances is migrating towards third party applications. That is what embedded banking is; APIs are the technology that makes embedded banking possible. Embracing embedded banking implies that the best-designed treasury portals will be the digital branches of the future. Treasury portals will be ‘visited’ by clients as a manual transaction backup channel, for service escalations, and as a security/control center.

Most clients, being only infrequent visitors, will develop only fleeting familiarity with the bank’s online application suite - so there will be continued demand for bank personnel with specialized systems or process knowledge. Instead of being physically present in the branch, they will need to be digitally-conjurable, to assist with infrequent transactions, verify identity & authority, and advise on security/control matters.

More banking APIs mean more applications can develop specialized and differentiated experiences that will result in massive productivity, risk management, and cost benefits to businesses.

The Treasury Portal in 2025

As third party apps become a primary interface for interacting with the bank’s products, services and data, you need to start asking what is the role of your bank's treasury portal?

Banks can utilize their treasury portals to compliment APIs and embedded service delivery. Here are two examples where treasury portals can strengthen the bank’s brand promise, even as 3rd party apps become the primary transactional channel.:

- As the primary application security/control/audit center

- As a dynamic transaction authentication service

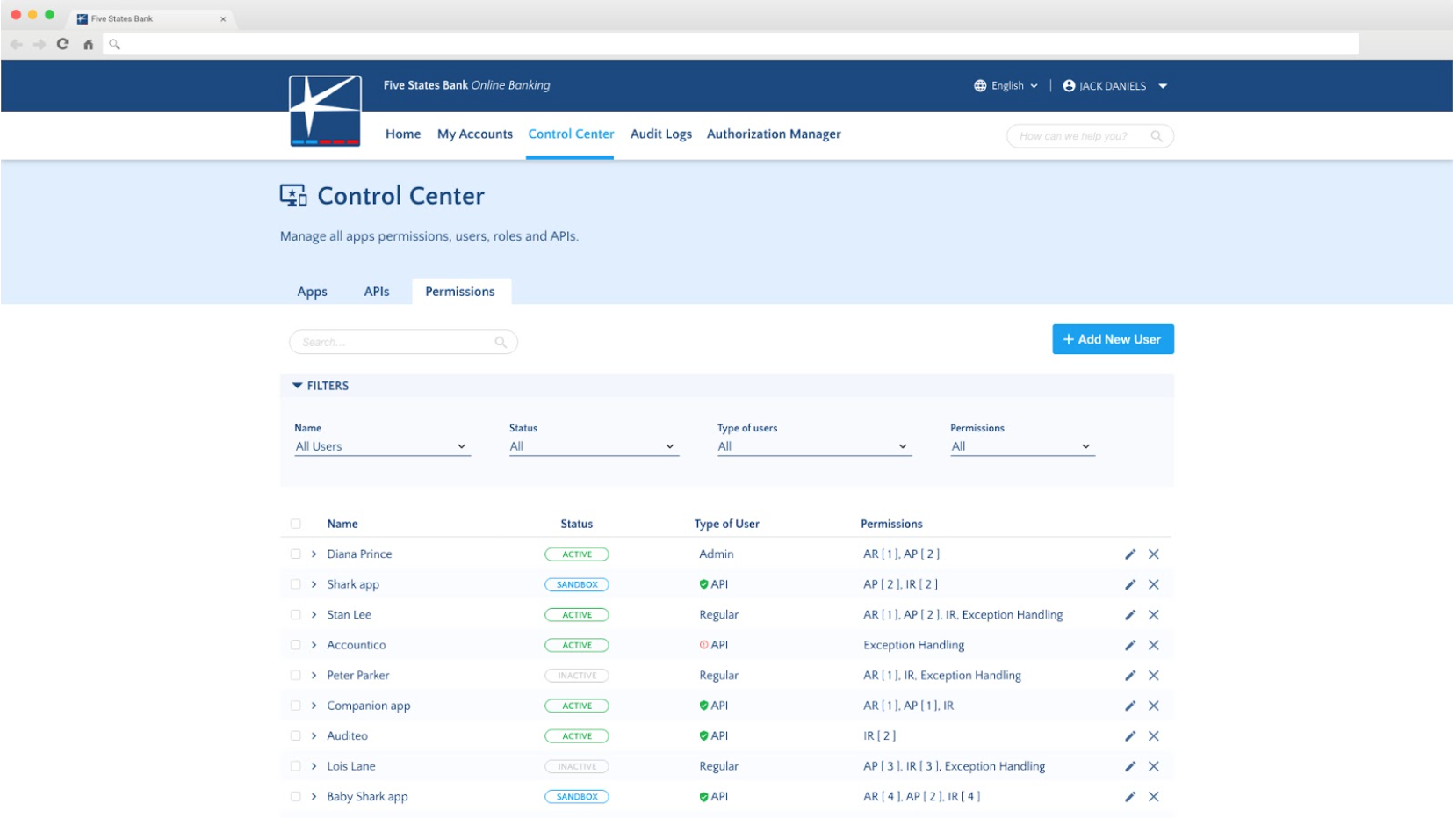

Personnel entitlement is already part of a typical bank’s treasury portal, since businesses need to control what financial actions each staff member can conduct, and configure things like dual-signing protocols for large or unusual payments. A next-generation treasury portal will extend the scope entitlements beyond just people, aware that embedded and third party apps are just as likely to conduct banking actions as humans are. Entitlement screens will support configuration, activity review, and revocation of access for APIs and Applications akin to personnel, as shown in the diagrams below:

FIGURE 1: ENTITLEMENT CONFIGURATION FOR PEOPLE, APIS, and APPS

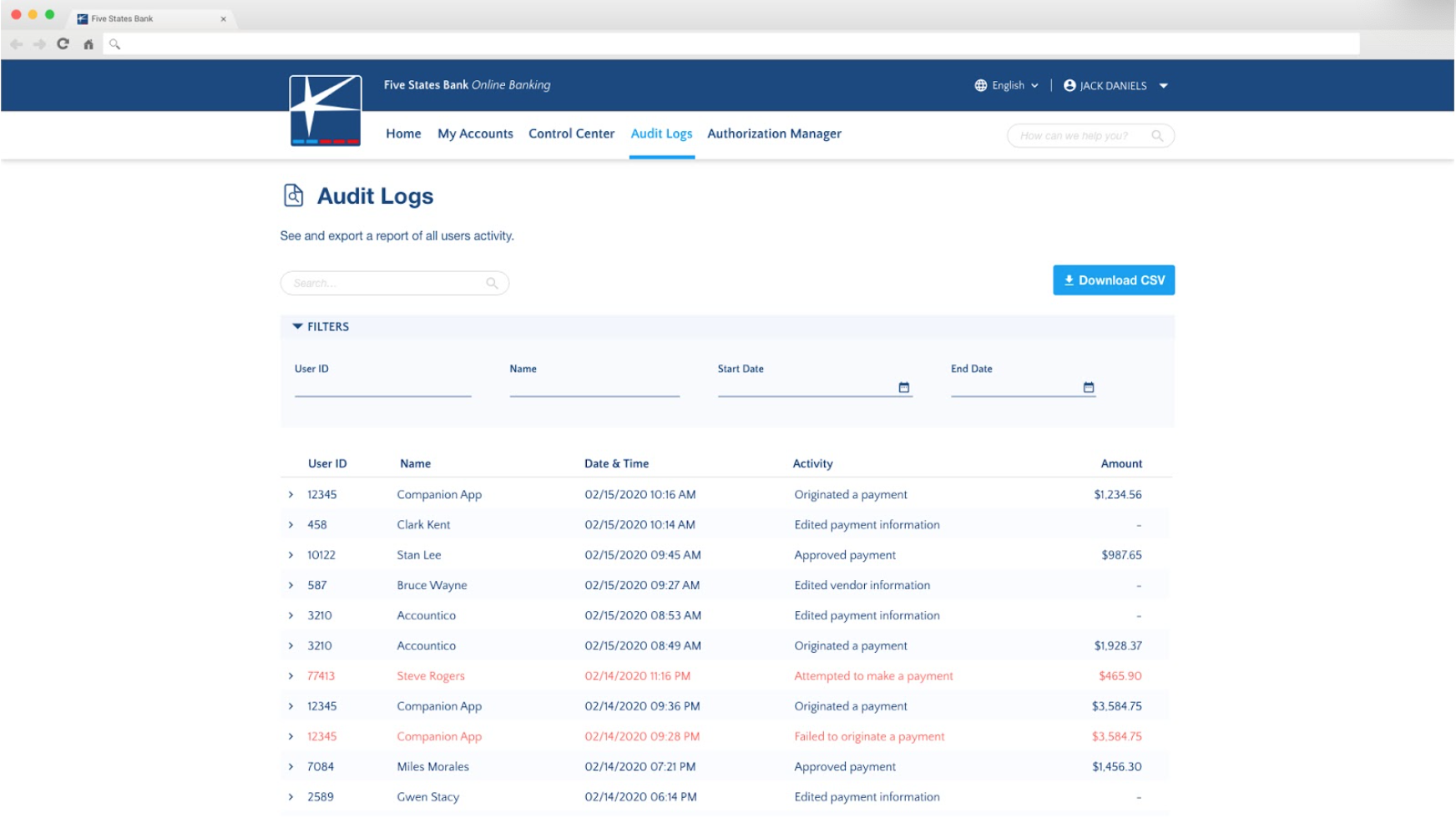

FIGURE 2: AUDIT LOG FOR PEOPLE, APIS, and APPS

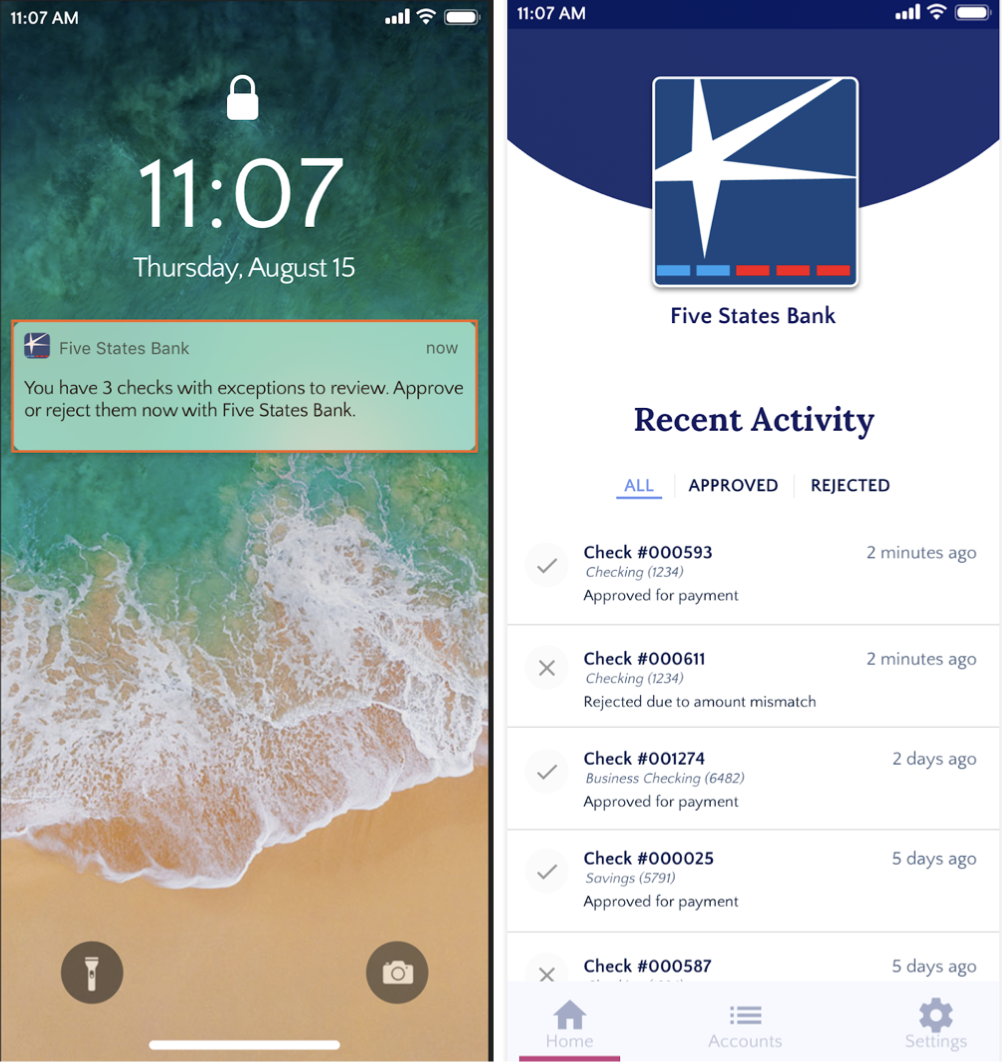

The second way bank’s can embrace 3rd party service initiation in a brand-enforcing way is through dynamic client authentication. Consider a request coming into the bank from a 3rd party procure-to-pay application to move money on behalf of a client. Using the bank’s treasury portal in figure 1, above, the client might configure a rule like whenever more than $X is moved via service Y, require at least one of person A or B to be authenticated by the bank and approve the payment for release. The client gets both the efficiency benefit of having an embedded application experience, plus the risk management benefit of secondary approval coordinated by their bank. An example of what this might look like on the bank’s mobile service is shown below:

FIGURE 3: BANK MOBILE ALERTING/CONTROL APP FOR BUSINESS CLIENTS

Treasury Portals are becoming increasingly large, complex online applications. Their functionality creates a center of gravity beyond the clients own business domain, which is why clients will continue to adopt financial services that extend more into their domain, allowing clients to derive greater benefit from finer-grained, in-situ service delivery through business applications.

There will be hard work that needs to be done to ensure the Treasury Portal and the Bank are perceived as value add to the client in her world however, there are a multitude of value propositions that the bank can offer. By assuming one of the primary roles is as a hub of control and configuration around the people and applications that are using bank data and services on behalf of your business banking clients, I believe there is an opportunity to differentiate and win.