Open Banking - What's In It For Banks?

Open Banking is no longer just an industry buzzword. From greater customer engagement to customer retention, find out the top open banking advantages for banks.

The global open banking market is growing faster by the day. Projected to hit $48.13 billion in 2026, its expansion can be traced back to the rise of online payment platforms and the various APIs behind them. With the emergence of open banking around the globe, let’s first dive deeper into what exactly open banking is and what’s in it for your bank.

Open banking is a system that enables third-party financial service providers (like FISPAN!) access to consumer banking, transactions, and other financial data from financial institutions (FIs) through the use of application programming interfaces (APIs). In a Finastra study, 86% of FIs are aiming to use open APIs to enable open banking within a 12-month time frame, where customers are given the ability to authorize third-party organizations to use and access certain aspects of their data. In turn, this helps both banks and third parties innovate and develop better services and offerings to meet their clients’ demands. Because third parties leverage their skills and build these products in a shorter time frame, this gives banks more time to focus on what they themselves do best, the customer experience.

Nowadays, digitization isn’t seen as a competitive advantage. For banks, digitization is a must to even stand a chance in competing with other neo-banks that offer more digital capabilities to commercial customers, especially for small and medium-sized businesses (SMBs). The financial services industry needs to digitize, as just relying on your traditional bank name is no longer enough. Embracing open banking is a critical strategy for banks who want to strengthen their digital offerings and presence.

How Have Customer Needs Changed?

Banks would cease to exist without their customer base, which is why fulfilling their needs is of the utmost importance. With technology at their fingertips everywhere and at any time, customers are now looking for more personalized experiences that are most convenient for them. In a 2021 digital banking report, Mobiquity found that 81% of American banking customers aged 55 and below preferred to complete transactions and access their banking accounts at times that worked best for them. With convenience being a key motivator for corporate users, banks need to innovate rapidly to end the use of manual and tedious processes that have been so representative of commercial banking. As expectations continue to change over time, banks need to meet these changing demands, else be left with customers who now have the option to take their business elsewhere.

Where Are Banks Currently?

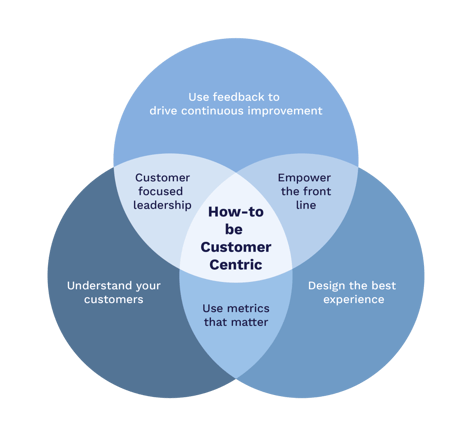

In an effort to innovate and innovate rapidly, the legacy systems that surround banks have slowed them down significantly, a clear differentiator from the skill, agility, and flexibility of tech companies. 95% of top global banking executives said that outdated legacy systems have slowed their efforts to optimize customer-centric growth strategies. Emerging technology paired with changing customer demands continue to put pressure on banks; though we’ve witnessed rapid growth in digital banking in recent years, it still pales in comparison to the financial experiences that individuals and businesses have come to expect in today’s modern age. Many businesses are still struggling with manual processes in their finance teams that need to be changed.

Open banking can empower FIs, fintechs, and businesses to experience this change through solutions such as embedded finance, in which the banking experience is brought directly inside the context in which each business lives. Banks can now offer their clients a more valuable accounting and treasury management system by embedding banking inside an ERP or accounting system, so that the customer doesn’t have to manually switch between portals.

What’s in it for banks, you ask? Let’s find out the top advantages of embracing open banking below.

The Top Open Banking Advantages For Banks

1. Retain and Attract Customers

With shifting customer expectations, open banking can help retain existing customers who are looking for more convenient and digital offerings from their FIs. According to the World Retail Banking Report 2022, 75% of customers are attracted to cost-effective and seamless services that are representative of fintechs, which grows their expectations for digital banking. In the same study, half of the respondents shared that their current banking relationships were neither rewarding (49%), nor fun (52%).

New solutions can be built with open banking, which not only increases customer satisfaction by giving clients improved access to data, but also results in extended reach, as current capabilities will grow and potentially reach more customers.

The SMB market represents a huge opportunity to attract a new customer base for banks. Though banks have always tended to underserve SMBs, this market has increased by 32% since 2019 and FIs should utilize open banking opportunities to capture a portion of this growing market. As SMBs continue to become a priority for FIs, the open banking API ecosystem can help create easier payment services that overcome this audience’s payment frictions. Our article, “Why Banks Should Prioritize Providing Integrated Solutions For Small Business Clients”, expands more on this topic.

2. Increase Innovative Offerings

Open banking increases opportunities to stay relevant in an increasingly competitive industry. As mentioned before, competition is rapidly growing and new strategies need to be introduced. For banks, open banking enables embedded banking to take place, a new innovative solution that will expand bank offerings while creating new diversified revenue streams. Forbes states that banks should pursue embedded banking because of two primary advantages: 1) efficiency (due to lower cost of customer acquisition) and 2) returns (banks who execute embedded finance strategies have a superior ROE).

3. More Fintech Collaboration

9 in every 10 financial institutions consider Fintech partnerships to be important to their business, up from 49% in 2019, and open banking can allow for more opportunities for fintech collaboration with your bank. Because open banking uses an omnichannel approach, financial institutions are able to work with one another to offer their customers more tools they otherwise wouldn’t have been able to have access to previously. You can find more advantages on bank-fintech partnerships in our blog post “Why Banks Are Ready To Embrace Fintech Partnerships”.

Collaborating with fintechs can also help banks save a significant amount of investment on digital transformation as fintechs can respond to these market opportunities quicker and speed up their time to market. In our webinar with JP Morgan, we explore how FIs, ERPs, and fintechs are partnering to help solve the most difficult treasury problems for finance teams.

4. Greater Customer Engagement

It is without a doubt that customers are looking for better ways to access data, and what better way to do that than with open banking. Because banks are able to open up their APIs with open banking, customers then receive a holistic view of their financial transaction history and simultaneously, better insights and custom recommendations based on their transaction history. This opens the door for greater customer engagement as customers improve their financial behaviour and decision-making.

__

Embracing open banking can help your bank realize long term growth. With benefits of open banking including customer retention, innovation, and greater customer engagement, open banking is becoming a necessary strategy as digitization grows. Banks will need to engage with FinTechs to make this possible as a way to stay relevant in this industry.

Check out our blog post, "What Open Banking Actually Means For Your Bank," to learn all you need to know about Open Banking; from its impact on customer experience and financial inclusion, to how your bank can prepare for the future.

To find out how FinTechs like FISPAN can help your bank get ahead of the Open Banking trend, schedule a demo with us here.