Using Co-Innovation to Embrace Embedded Finance

Driving technology innovation in any industry is difficult. Still, with the added complexity of IT budget approvals, state and federal regulation, employee training programs, archaic technology infrastructure, and the standard bureaucratic bank processes, you can see why innovation in the financial services industry is nearly impossible. On the other hand, bank clients are demanding better experiences as part of their everyday commercial banking activities. If both sides want the best customer experience, then why is it so difficult to get there?

The Embedded Finance Challenge Opportunity

The rise of embedded finance outlined by Forbes – the integration of financial services into non-financial websites, mobile applications and business processes – poses several opportunities to address this poor client experience. Across a range of financial services, including payments, lending, and insurance, embedded finance offers a new, very large addressable market opportunity worth over $7 trillion in ten years, twice the combined value of the world’s top 30 banks today as researched by Simon Torrence of Bain Capital Ventures.

Co-innovation Is The Answer

Banks are now developing new visions and strategies to access embedded finance capabilities such as:

- Develop the required functionality in-house and embed this new functionality into their digital banking platforms.

- Acquire a company that solves a specific pain point in the overall client experience, or

- Leverage existing complementary FinTech players as new distribution channels for banks’ products and services.

This is the classic build/buy/partner decision framework. Banks don’t have the time to pursue options 1 and 2, so they must partner with the right provider.

Leveraging the power of B2B co-creation is a powerful way to co-create new business value with your most important customers by closely iterating back and forth throughout the innovation process. B2B co-creation is not the same as B2B design thinking which uses customer insights at the beginning and end stages. B2B co-creation is about involving the customer throughout the innovation cycle – before, during and after.

From a client perspective, finance departments are looking ahead to new technologies and capabilities to improve and even transform their processes and effectiveness. FIS found an overwhelming majority cite bank APIs as the technology with the greatest impact. In addition, more than one-half recognize the transformative nature of real-time payments.

The J.P. Morgan Chase-FISPAN Co-innovation Process

FISPAN embarked on a co-innovation journey with J.P. Morgan Chase to develop a turnkey embedded banking experience within their client’s enterprise resource planning (ERP) platforms. This engagement was guided by the four key principles of co-innovation outlined by the Harvard Business Review. The end result is a successful strategic partnership that created the ultimate client servicing experience, which continues to evolve.

1) Clearly define the problem statement and goals to ensure stakeholder participation

The initial client request was to embed J.P. Morgan Chase’s banking features and functions within the client ecosystem without having to embark upon a large IT project that requires a significant budget or spending. Jason Tiede, Managing Director, Global Head of FinTech explains, “On our team, we spend a lot of time with our clients both sharing the perspectives of where we see the transaction banking payments business going as well as more importantly, listening to our clients who are treasurers and finance professionals. We listened to where they saw their business heading and how they wanted to evolve. Our team spends a great deal of time trying to understand what the client is going to look like in the future.”

FISPAN used this input to guide its development strategy and concentrate on ERP and accounting integrations, and broadening the number of platforms, businesses, and back-office/banking services to be integrated with it. We were able to hit the ground running with a number of solutions, including NetSuite and Sage Intacct integrations, that worked directly with the clients existing environments out of the box.

2) Focus on the experiences (not economic value) of all stakeholders

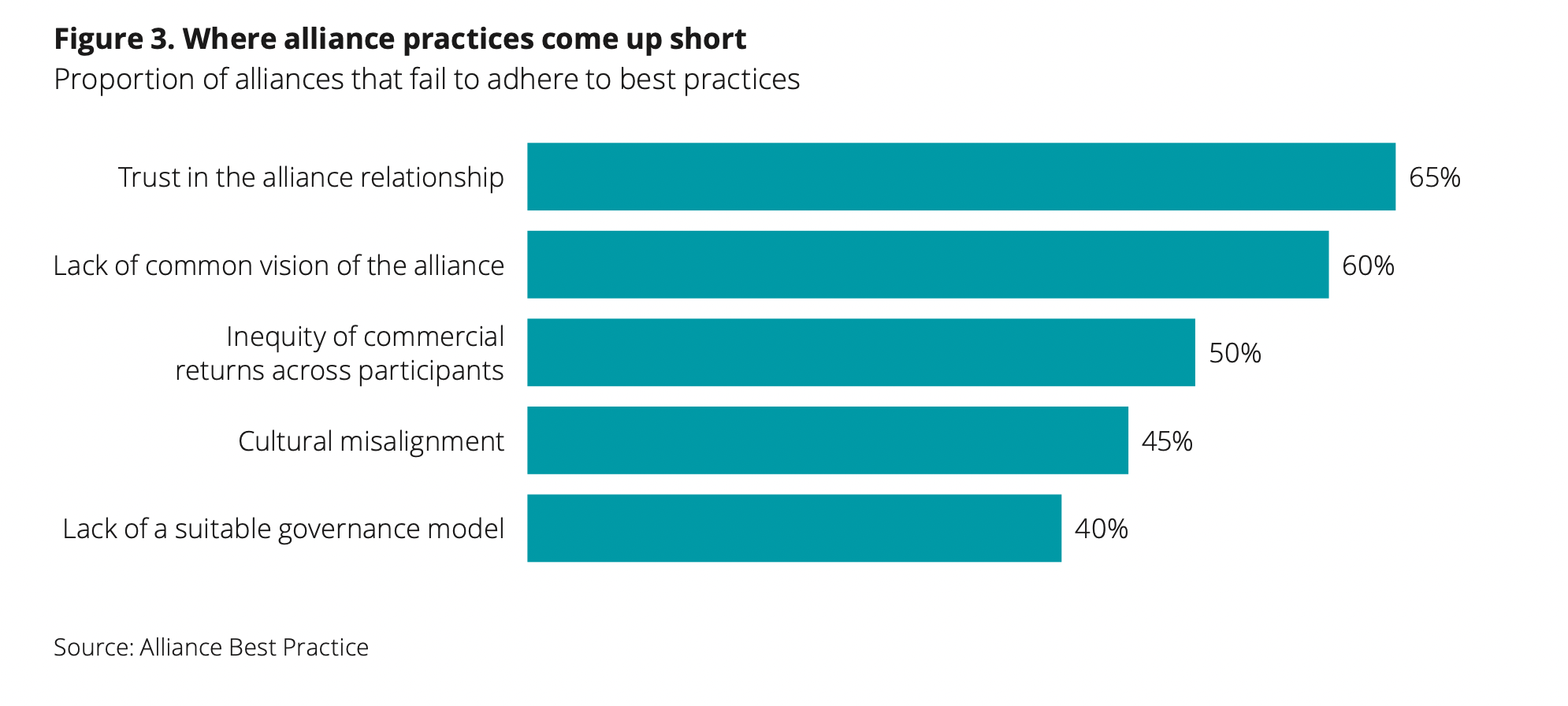

Both FISPAN and J.P. Morgan Chase knew that establishing trust in the relationship was essential from the beginning. This aspect is the usual downfall to developing and scaling most partnerships, a failure that is usually magnified when working with smaller fintech startups.

Presented in Deloitte’s Strategic Partnership Report

Jason was on the same page, “Surprisingly, the cultural differences were not apparent and did not hinder the working relationship at all. Right away, there was a bit of serendipity involved. Lisa (FISPAN’s CEO) and I met as her company was ramping things up and as my team was ramping up. We hit it off in terms of understanding this market opportunity. What I mean by this is the need for large-scale access to clients as well as the need to have the right controls and security in place.”

Simplifying the payments experience, reducing the manual effort required for account reconciliation, and enriching the ERP platform capabilities proved to increase client loyalty. The ERP and accounting partners upon which the JPMC application is hosted also viewed this partnership as an opportunity to attract new clients and strengthen their existing relationships.

3) Ensure that stakeholders can interact directly with one another

Most business problems are complex, and their solutions are not obvious. To address them, people with a wide range of expertise and perspectives often need to come together to hear and see the issues firsthand and work on a resolution. Co-innovation changes the way companies think about strategy and operations, whereby both groups become integral voices throughout the process rather than at the ends. From the beginning, FISPAN knew that regulation, compliance, due diligence, and the overall governance model of the relationship needed to be addressed before building any sort of solution. Lisa Shields, CEO at FISPAN, explains, “We had a high degree of attention and fidelity to things like infosec and operational designations that make it possible for an institution with the stature of JPMorgan Chase to work with us. Where an institution actually has an innovation group that has good working relationships with the business lines, the cultural expectations around walking us through and setting our expectations on the vendor onboarding process – what it means to go from POC to pilot with live customers and transactions – that wasn’t a shocker for us.”

4) Provide platforms that allow stakeholders to interact and share their experiences

The final pillar is enabling interaction and feedback throughout the process. Jason explains, “How did we prepare internally? It was that client's need, that client as

the arbitrator, as the guiding light. The other big piece was we brought our middle- and back-office teams into the dialogue very early on. We could then make sure to think about what they would need from a design standpoint and an execution standpoint, assuming it made it

to commercialization mode, which we are today. I think it was bringing the people around the table, but again the outside-in feedback was the winning formula.” FISPAN was able to accelerate the time to market of this solution while avoiding unexpected delays from complicated operational or infosec processes. With this cross-functional collaboration at the heart of the co-innovation process, FISPAN was also able to manage expectations and processes of the ERP and accounting partner programs to ensure a smooth go-to-market approach for the joint solution.

Partner For The Future

It’s no secret that banks want to deliver a better client experience but it’s often a difficult, expensive, and uncertain path when operating in uncertain markets or expanding into adjacent products or services. Partnerships present a relatively rapid means of gaining access to external capabilities when time-to-market, financial, or legal issues preclude the development of capabilities in-house. FISPAN offers the opportunity to develop the ultimate client servicing model while participating in the co-innovation process to see their product evolving in a way that they are not used to.

JPMC has proven that it’s essential to establish a relationship with the executive sponsor, identify the right cultural fit, and focus on the client's goals from the beginning. It’s also rare to find partners that have a high degree of attention and fidelity to governing bodies such as infosec and operational designations. This is what gives FISPAN the ability to work with the world’s leading financial institutions and ERP/accounting platforms. We move fast and aggressively to hone current offerings and develop new ones, always with the bank clients’ needs and voice in mind.

__

Join our partner network today to start your own co-innovation journey.