What Open Banking Actually Means For Your Bank

Open Banking is one of the hottest trends in financial services, but what does it mean for your bank? From enhanced customer experiences to global financial inclusion, find out how you can get ahead in this blog post.

Table of Contents

What is Open Banking?

Open Banking Across the World

How Open Banking Impacts The Customer Experience

Accessibility and Affordability Brings Financial Inclusion

How Banks Can Prepare for Open Banking Success

Unfolding The Future of Open Banking

What is Open Banking?

Open Banking is on the rise across the globe, but what is it?

Open Banking is defined as an emerging banking practice that provides third-party financial service providers open access to consumer banking, transactions, and other financial data from banks and non-bank financial institutions (FIs) through the use of application programming interfaces (APIs).

Open Banking is a secure way for financial institutions to provide third-parties, such as FinTech companies, access to consumer data and APIs. With access, third-parties can develop additional, improved banking products and services in a shorter period of time.

“Those who’ve embraced open banking have seen how it has made it easier for customers to access FinTech products or even open accounts with other financial institutions while still transacting through their main bank’s platforms. Rather than getting frustrated with their bank’s limitations, customers will benefit by the ease in which they can work with their original institution.” - Clayton Weir, CEO and Co-Founder, FISPAN

By allowing third-parties to access client data through APIs, banks can make it much easier for consumers to open bank accounts, for businesses to pay vendors quicker, to see a company’s entire financial outlook, and much more. That’s the promise of Open Banking.

Open Banking may seem like a scary term, but it really is the concept of driving innovation through collaboration. As markets digitize and new unicorn companies like Uber and Shopify emerge (that focus on catering towards convenience in the user experience), the need for the financial industry to digitize increases tenfold. Open Banking encourages collaboration throughout all levels of the financial sector and will streamline the innovation process while catering to personal, retail, and business banking.

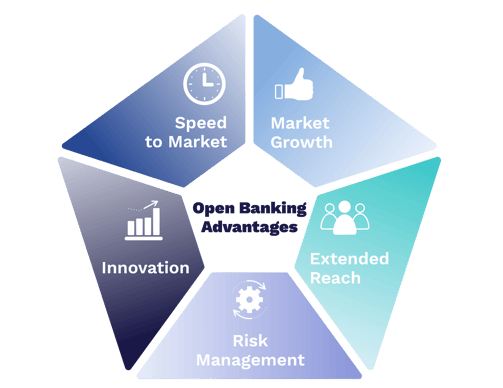

There are many advantages to embracing Open Banking and open APIs, the top five being:

-

Speed to Market:

Banks, FinTech and other third-parties can respond to market opportunities quicker and speed up their time to market.

-

Innovation:

New innovative products and services will be introduced and developed through collaborative partnerships across the financial industry.

-

Risk Management:

The ability to significantly improve compliance and regulatory reporting.

-

Extended Reach:

New products and collaborations will extend current capabilities and reach an extended customer base.

-

Market Growth:

The financial industry is already a vibrant marketplace, but Open Banking will accelerate the ecosystem growth even further.

Open Banking Across the World

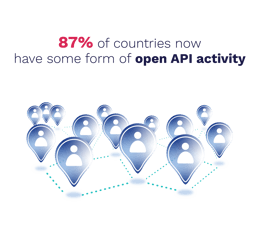

Open Banking is becoming prioritized and recognized worldwide as the best tool to bring the financial industry into the future. Today, 87% of countries now have some form of open API activity.

Open Banking is becoming prioritized and recognized worldwide as the best tool to bring the financial industry into the future. Today, 87% of countries now have some form of open API activity.

Open Banking adoption tends to be either market-driven or regulation-driven. Europe and Australia are prime examples of regulation-driven Open Banking compared to the more market-driven United States.

Regulation-Driven Open Banking in Europe & Australia

In Europe, government regulations moved financial institutions towards open APIs and data sharing through the Payment Services Directive 2 (PSD2). PSD2 is a European regulation for digital payments that encourages innovation in the financial industry by allowing third-parties to access bank infrastructure.

It’s been three years since PSD2 came into effect, sufficiently encouraging financial institutions to invest in their open APIs and access new tools that will aid them in executing their API strategy. Large banks like Barclays and BBVA have opened their APIs to third-parties to comply with these new regulations and embrace Open Banking. An example of how Barclays has leveraged Open Banking - users can now see and manage their outside bank accounts within their banking app.

In Australia, since July 2020, consumers have had the Consumer Data Right (CDR) to give accredited third-parties, like FinTechs, access to their financial data. Bank customers now have greater access and control over their financial data and choose to send their data to accredited businesses, authorized banks, financial institutions, and organizations.

As of December 2021, 16 Australian banks representing 85% of Australia’s household deposits are active data holders, and 13 data recipients like FinTechs, accounting platforms, and comparison providers have been accredited while many others are currently undergoing the accreditation process.

New partnerships between banks and FinTechs are emerging, leveraging each other's experience and expertise to create new banking capabilities and products. Other countries like New Zealand are already working to align their data standards to Australia’s CDR framework.

This initial Open Banking launch and its accelerated growth in Australia are just the beginning because the possibilities have skyrocketed with increased data sharing. Potential future projects include accredited entities being allowed to initiate payments on behalf of a customer, flexible outsourcing and specializations, and applying this framework to other industries like telecommunications.

Open Banking has been thrown forward in countries driven by regulation. To catch up, we will see other governments, like the Canadian government, follow suit and introduce their own Open Banking mandates in the coming years.

Market-Driven Open Banking in the United States

In most markets around the world, government regulations have been at the forefront of Open Banking, but FISPAN’s CEO Clayton Weir says, “in the United States, there's competitive pressures and reasons that banks, FinTechs, and others involved in this ecosystem have forced the market towards more openness or aspects of connectedness without the guiding hand of the government.”

The United States banking system is unique in that there are around 5,000 commercial banks and an additional 5,300 credit unions. Within that, there’s not just one or two powerful financial services regulators as seen in other countries; instead, the U.S. has at least nine significant regulators. Despite the lack of Open Banking regulations, market-based competitive forces have manifested a version of Open Banking into the United States over the last two years. Banks understand that with the combination of customer demand, the pain of legacy systems, and the opportunity connected banking presents, there’s great value to be obtained by investing in Open Banking.

“Many small-to-medium businesses (SMBs) are feeling neglected by banks. Open Banking is a big part of this conversation, and we are beginning to see some market-based momentum around it. Open Banking is showing up in North America as a direct response to the market opportunity.” - Matt Naish, Head of Product Strategy, FISPAN

In an interview on the If I Ran the Bank podcast, Ben Isaacson, SVP of Product Strategy at The Clearing House, suggested that the U.S. may have had Open Banking 20 years ago when companies like Yodlee began screen scraping successfully and acquiring data from bank accounts without actually having to go to the bank. Meaning, the same innovation that has been driven by those government regulations in other markets has been happening in the U.S. private sector for the last 20 years. The difference now is that the government regulations across the pond are driving and growing adoption rates much faster than in markets without Open Banking regulations.

To learn more about how Open Banking can help your bank succeed, as seen in Europe, take a read of our blog post, "Demystifying Open Banking: The Inevitable Future For Your Bank."

How Open Banking Impacts The Customer Experience

In our technology-driven world, convenience is a key motivator to both tech users and tech providers. The ability to manage our finances at the very touch of our fingertips is quickly becoming a critical determinant for where consumers choose to bank. A 2021 Digital Banking Report by Mobiquity reported that 81% of American banking customers aged 55 and under prefer to access their accounts and complete transactions at times that work best for them. From the same segment, 49% indicated that switching banks is now easier than ever before—with a majority who say they would indeed change banks if it meant accessing better digital capabilities.

However, the same can’t be said for the commercial banking space, which, despite the rapid digitization we’ve seen in retail banking over the last decade, is still far below the level of financial experiences that many businesses have come to expect. Today, there is a seemingly endless number of manual, tedious, and inefficient processes that commercial clients are forced to carry out in order to run their day-to-day operations.

“Just as customers are getting more comfortable doing their personal banking online, business clients are also turning to digital banking platforms as an alternative to in-person branch visits.” - Clayton Weir, CEO and Co-Founder, FISPAN

As a result, banks are struggling to keep up with the growing demand for digital services and need to innovate in ways that keep their business customers loyal. Here lies a huge opportunity for banks and businesses alike to leverage the breakthroughs provided by Open Banking and embedded finance. By embedding the banking experience inside the very platforms that customers rely on to run their businesses every day, such as ERPs or accounting software, banks are able to offer their clients a more automated and streamlined treasury management process overall.

Financial institutions will always have to face the difficulties that come with changing customer expectations; it’s an inherent part of next-gen advancements, especially in technology. On top of this, banks will continue to be increasingly challenged by the need to adapt to the open exchange of data. This exchange is quickly progressing among the many FinTechs who are finding ways to meet these changing client demands faster than traditional institutions.

At a time when the competition to attract new customers (while maintaining existing ones) is at an all-time high, banks need to open themselves up to new ways of collaboratively thinking and working. Those who have embraced Open Banking have already seen the ease in which their customers can access FinTech products or open accounts with other FIs, while still transacting through their main bank’s platforms.

At a time when the competition to attract new customers (while maintaining existing ones) is at an all-time high, banks need to open themselves up to new ways of collaboratively thinking and working. Those who have embraced Open Banking have already seen the ease in which their customers can access FinTech products or open accounts with other FIs, while still transacting through their main bank’s platforms.

In partnering, serving, or investing in innovation by way of technology upstarts, financial institutions are better able to position themselves for future growth and adaptation. With real-time—and much easier—access to products, services, data, and channels, banks can ultimately deliver financial solutions that truly resonate with their customers and the ongoing challenges many businesses face in today’s rapidly growing digital market.

Accessibility and Affordability Brings Financial Inclusion

Approximately 31% of adults worldwide fall into the unbanked population, with over seven million of these individuals living in the United States. “Unbanked” refers to segments of society that do not have bank accounts managed through financial institutions or mobile money providers, and have little to no access to proper financial support. Without a bank account, those who do try to save are forced to turn to alternative forms of financing like payday lenders, check cashing, or even the old fashioned “storing money under a mattress.” Not only do these measures tend to be risky and more costly, but it also makes it much more difficult to build up the reserves that allow people to access vital financial tools like credit and insurance.

Today’s digital-first world has driven technology to a level that enables increasingly greater accessibility to essential services—one that can ultimately help reach the unbanked. Advancements from FinTech and Open Banking will allow financial service providers to offer a broader range of services at a lower cost, offering targeted services to underserved segments, and thus making financial inclusion both attainable and sustainable.

Up until this point, innovators have had to make do without meaningful access to financial data and the payments ecosystem. FinTechs in North America have worked to create value through rudimentary methods such as screen scraping (a practice FISPAN does not recommend!) rather than the Open Banking regulations and initiatives that already exist in other countries. Although there is increasing pressure to evolve Open Banking in the U.S. and Canada, FISPAN’s Clayton Weir believes “we’re [still] a few years out from having a defined Open Banking policy.”

Through Open Banking and APIs, financial institutions are able to securely share their commercial clients’ financial data with third-party providers like FinTechs (such as FISPAN). By enabling this free flow of information between parties, known as data transparency, both banks and FinTechs are able to offer new applications and services that better cater to the needs of their customers, including those who remain unbanked. For these unbanked users, the new solutions also remove many of the technical requirements that come with traditional banking, since many transactions can now simply be performed using a mobile phone.

As the economy continues to transition back into a sense of somewhat normalcy, it’s key to remember how the events of the pandemic underscored the importance of digital and accessible banking like never before. In an interview with American Banker, Weir said, “regulators must continue to craft Open Banking rules to help usher unbanked individuals into the financial ecosystem.” At a critical time of accelerated and disruptive innovation, increased financial inclusion will need to become a focus for FIs and their counterparts to capture more of the market and retain existing clientele—both now and long after the pandemic subsides.

How Banks Can Prepare for Open Banking Success

Now that banks are interested in adopting Open Banking, they must make sure they have the right technology and strategy to make Open Banking work for them and their clients. If your bank isn’t acting now, competitor banks, multinational banks, and start-ups will begin to deliver these better banking experiences to your clients before you do.

“Institutions who were initially reluctant to make the shift to digital processes have had to quickly adjust to growing demand and expectations. Additionally, new functionalities like embedded finance have highlighted that traditional banks were not fully equipped to make rapid digital moves. The importance of Open Banking and the scalability allowed by the use of white label BaaS solutions provided by FinTechs emerged to fill that gap.” - Clayton Weir, CEO and Co-Founder, FISPAN

Here are four ways your bank can prepare for Open Banking:

- Get rid of your legacy systems

One of the biggest challenges limiting financial institutions from full Open Banking potential are legacy systems. Many of these systems banks spent years building are no longer compatible with today's digital world.

To embrace Open Banking, banks must rely less on their ageing system infrastructure and invest in digital transformation, specifically towards the cloud. We have already seen influential banks like J.P. Morgan Chase champion the move to the cloud. The majority of accounting systems, ERPs, and platforms that banks will need to interact with operate in a cloud environment. However, moving everything towards the cloud is not the sole solution, but just part of it. Ripping out and replacing legacy systems is easier said than done, but failure to do so can be detrimental to growth.

- Seek out partnerships

The future of finance requires collaboration between banks and FinTechs. If banks embark on digitization without external support, it will take too long, cost far too much, and they will fall behind their competitors who went to market with their new products years earlier. Open Banking makes it easier for banks to provide these new and improved experiences to their customers without having to build the infrastructure themselves.

Partnerships offer a rapid means of gaining access to external capabilities when time-to-market, financial, or legal issues arise with the development of products in-house. Banks can significantly benefit from partnering with a FinTech that already has an API foundation. For example, FISPAN partners with banks to develop corporate banking solutions that connect the bank’s system directly into existing ERP platforms, creating an embedded banking experience. Banks need to be prepared to work with third-parties and co-innovate to embrace Open Banking. FISPAN’s Head of Partnerships, Kamal Hassin, wrote an in-depth piece “Using Co-Innovation to Embrace Embedded Finance” on how collaborating with FinTechs has helped global Tier 1 banks like J.P. Morgan Chase create a better customer experience. - Develop an API strategy

Banks that combine their API and cloud strategies can introduce client-facing innovations quicker, employ a faster onboarding experience, and save time and money. The catch is that just because a new product or service is made available through an API, doesn’t mean clients will start to use it. To drive usage and increase interest, banks need to make the API important to the customer journey.

While creating an API strategy, banks need to analyze not only how they can use APIs but how they can make them relevant to their customers through convenience, simplicity, and ease of use. Many banks are currently building new APIs to support their internal efficiency rather than for the client—but that needs to change. Factor the customer experience into your API strategy, including what their intentions or goals might be with the API.

Open Banking and APIs are already changing the face of business banking, and there are many new opportunities for banks to truly unlock this potential. By using APIs, banks will be able to divide their focus on offering their corporate clients better integrated and agile tools, as well as creating new innovations.

Banks do not have to do this on their own. As we previously mentioned, partnering with FinTechs like FISPAN or other third-parties can mean developing APIs for your customers quicker and emerging as industry innovation leaders. - Ensure security

Financial privacy and the security of customers’ financial data are of the utmost importance. Banks are already focused on staying ahead of the latest data security, privacy issues, and fraud risk, but they can apply this mindset to their digital transformation and move towards Open Banking as well. Change comes with a risk, but there is risk everywhere: from data breaches, fraud, malicious third-party apps; you name it. In countries with regulated Open Banking, there have been standards and accreditation processes put in place to ensure and enforce data security.

Open Banking puts the customer in control of their own data and forces APIs to become secure. Open Banking is not meant to create an un-secure environment, but instead to build safe, trustworthy collaboration between banks, businesses, FinTechs, and consumers. To prepare for Open Banking, banks can review their security architecture, develop and ensure appropriate controls are in place to monitor fraud, and understand the security implications of moving towards the cloud, partnerships, and open APIs.

Unfolding The Future of Open Banking

If the pandemic has taught us anything, it’s that we can’t predict the future. But, what we can expect is a highly digitized world. As offices emptied with the shift to remote work, many businesses were forced to seek new ways to eliminate their manual and paper-based accounting processes. two years later, we have seen how the digitization and innovation of banking solutions has accelerated at a much faster rate. While many companies have started to return to business-as-usual, one thing that won’t change are the experiences they expect from their banks.

A Changing Financial Landscape

With a greater push for regulators to adopt Open Banking in Canada and the U.S., we have seen the—once non-existent—number of bank-FinTech partnerships grow. FIs are finding more comfort in sharing their data, and their clients’ data, with third-parties in order to provide their customers with the seamless banking experiences they desire. For corporates, the embedded solutions brought about by open data will eliminate the need for users to become payments or banking experts and instead allow them to focus on what they do best: running their business.

For small and medium businesses, however, there is still a massive opportunity to seize for banks—one they may soon lose out on. Banks today possess a wealth of opportunities to serve SMBs in the ways they expect, yet small businesses remain as the most underserved banking segment in North America. Considered to be too risky and costly of a challenge, FIs have tried to weigh their pros and cons, but their hesitance has all but set them back in the digital banking battle with neo-banks, FinTechs, and other third-party service providers. PYMNTS discusses the market opportunity revolving SMBs, and how they can be best served through APIs in the Next-Gen Commercial Banking Tracker found here.

Opportunities To Come With Open Banking

Over the next few years, it’s likely that the governments that haven’t done so already (in North America particularly) will regulate FIs to become more transparent with their data, says Matt Naish, FISPAN Head of Product Strategy, in the 2021 Open Banking Expo Report. What does this mean? Banks will have to share their clients’ information (with consent) with other institutions and FinTechs. Open Banking will ultimately give ownership of such data to the consumer, including SMBs, and provide the framework that will enable business banking customers to make healthier financial decisions.

Real-Time Payments (RTP)

Even with payment rails like ACH and wire, businesses today are still relying on financial models that are based on paper checks. Retail banking customers, however, get to reap the benefits of sending and receiving money instantaneously through platforms like Venmo, e-transfer, and Zelle. In episode 13 on the If I Ran the Bank podcast, Lou Towchik, treasury management consultant and former SVP at Huntington Bank, discussed how securing these same real-time transactions for businesses are accelerated in a faster payments world—it’s just a matter of applying the proper tools. With an introduction to the ISO 20022 payment structure, he says that allowing AP systems to easily talk to other AR systems will ultimately be what pushes businesses to move away from paper checks.

A virtual card is a credit card that’s just that: virtual. There is no physical aspect, just a uniquely generated card number designed to mask your personal account information across every transaction. It flips the traditional credit card on its head, allowing the user—not the card-issuing company—to control how much can be spent, where, and when they should be disposed of. While regular credit cards may expose your banking details in the event of a data breach, or frequently fall victim to fraud, virtual cards have extra security to ensure your actual account is not compromised.

Bank (Data) Feeds

Bank feeds will similarly be a game-changer in the (near) future. Today, the biggest challenge in achieving embedded capabilities lies in the data connectivity that can be established between banks and the third-party vendors themselves. But through bank feeds, or data feeds, the link between a business’ transactions and their ERP or accounting software is automatic—meaning, valuable banking information is securely exported and then directly imported into the client’s reconciliation modules.

In order for real-time payments, virtual cards, and bank feeds to truly transform the banking world, FIs and card networks will need to be able to exchange information with their customers’ systems of records in real-time. How? Well, through Open Banking-enabled APIs and ERP connectivity.

From what we know and what we’ve seen, open and embedded banking is indeed the future of financial services. Between enhancing customer banking experiences and enabling real-time connectivity between partners, the potential for open data in banking is massive. However, while we have only seen the tip of the iceberg when it comes to the power of Open Banking, rest assured, adopting the modern tools and technology needed for banks, businesses, and vendors to prevail has never been easier.

__

To learn how your institution can get ahead on the wave of Open Banking and revolutionize the banking experience for your commercial clients, book a demo here.