Why Banks Are Ready to Embrace Fintech Partnerships

FISPAN recently hosted a webinar on Banking & Fintech Partnerships detailing how Fintechs can support Banks’ API, open banking, and embedded finance initiatives. Read on to learn about the many benefits a bank can obtain when partnering with the right Fintech. The webinar ‘ Friend or Foe? 5 Ways Fintechs, APIs & ERPs Unlock Hidden Business Banking Revenue’ is currently available on demand for a limited time. Watch the full webinar on demand now.

Bank-Fintech partnerships have been a hot topic for many years in the financial industry. With the global emergence of open banking and the onset of numerous financial technology firms (Fintechs) appearing and thriving in the financial space, there was at first an adversarial aspect to these new entrants. However, a recent report from Cornerstone Advisors, ‘The State of the Union in Bank-Fintech Partnerships’, found that nearly 9 in every 10 financial institutions consider Fintech partnerships to be important to their business, up from 49% in 2019. This finding shows a significant and positive shift in approach to the Fintech sector.

So, what’s driving this change? Why are Financial Institutions now clamouring for Fintechs’ attention?

The Rise of ERP Banking

By 2025, embedded finance could expand corporate banking revenue by nearly $100 billion globally and command more than a 25% share of the entire market. Embedded finance refers to integrating financial services into everyday products and services.

As such, it's important for both financial and non-financial institutions to understand the potential value of embedded finance to business clients and how this will prove to be an asset for the bank. Through embedded finance, businesses can create a competitive edge and drive customer loyalty by offering their customers convenient, accessible, and affordable financial solutions.

An example of an area primed for Fintech involvement is ERP Banking. Recent investment in ERP, TMS, and accounting systems has exceeded $100B a year. As corporate clients continue to make huge investments of time and money into their treasury management systems, they need their financial services providers to also invest in those systems and technology.

In recent years, financial institutions have embraced APIs, recognized the necessity of embedded banking solutions, and are actively working towards digital-first transformations, all the while struggling to balance decreasing budgets against increasingly complex company objectives. Could it be that ERPs and Fintechs are the solution to many of their woes?

Getting To Know Your Bank

Banks are constantly striving to connect directly with their clients and meet them where they live. Today, where their business clients are living is in their ERP or accounting systems. Commercial clients are doing the majority of their day-to-day activities there and those systems are becoming more and more advanced. Increased business functions — anything from warehouse inventory tracking, to CRM, to employee vacation time approval, are now migrating to ERP and accounting systems. What hasn’t been historically included in those ERP and accounting systems is banking and the wealth of banking tasks they have to perform.

For the majority of bank clients in the mid-market enterprise space to small and medium businesses, they're looking for a solution, such as an app or similar to make their ERP/TMS lives a bit more streamlined.

Partnerships between banks and Fintech companies allow banks to offer their customers useful tools and features that they might not have been able to provide without significant digital transformation investments.

How banks benefit from partnering with a Fintech

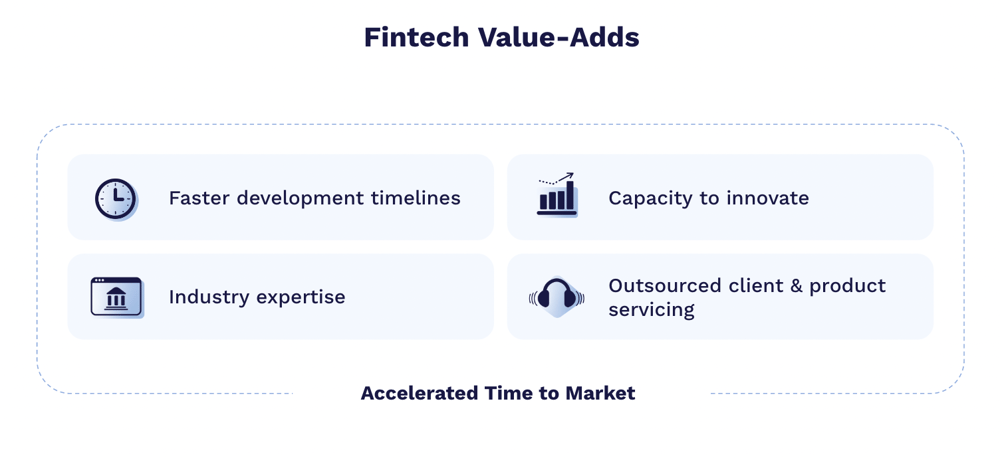

Faster Development Timelines

Fintechs can augment a bank's digital transformation development timelines. Banks may already have active projects, like an API portal for example, in varying stages of development: just beginning, in the middle of a long process, or completed but stuck in the rollout stages for some reason or another. At any stage, Fintechs can support the bank’s capacity to innovate; from bringing industry experience, connecting to actual backend bank systems, getting systems into a client’s accounting or operational systems, or with outsourcing the entire product and service. The right Fintech will often provide resources, people, and processes to partner with the bank to help them get to market, to service it, to onboard customers, and provide support through the journey.

Fintechs can augment a bank's digital transformation development timelines. Banks may already have active projects, like an API portal for example, in varying stages of development: just beginning, in the middle of a long process, or completed but stuck in the rollout stages for some reason or another. At any stage, Fintechs can support the bank’s capacity to innovate; from bringing industry experience, connecting to actual backend bank systems, getting systems into a client’s accounting or operational systems, or with outsourcing the entire product and service. The right Fintech will often provide resources, people, and processes to partner with the bank to help them get to market, to service it, to onboard customers, and provide support through the journey.

When you partner with a Fintech, you acquire dedicated resources who work on these specific projects, who then develop easily repeatable processes for connecting banks to their clients' various ERP systems.

Increased Capacity to Innovate

Traditional Banks typically fund projects with all of the risk and analysis done upfront to determine the projects’ viability prior to approvals and funding. This is all done to ensure almost guaranteed success. Alternatively, Fintechs can have dedicated internal innovation teams that are funded, not on the criteria of guaranteed success, but on the basis that failure is okay, as long as the learnings are used to improve client projects. This innovation team can onboard beta users and groups to securely test new ideas, processes, procedures, and products. In these instances they are given the freedom to intelligently test a hypothesis with a small subset of the actual market and use what they’ve learned in real time to inform other initiatives and improve upon existing projects.

Traditional Banks typically fund projects with all of the risk and analysis done upfront to determine the projects’ viability prior to approvals and funding. This is all done to ensure almost guaranteed success. Alternatively, Fintechs can have dedicated internal innovation teams that are funded, not on the criteria of guaranteed success, but on the basis that failure is okay, as long as the learnings are used to improve client projects. This innovation team can onboard beta users and groups to securely test new ideas, processes, procedures, and products. In these instances they are given the freedom to intelligently test a hypothesis with a small subset of the actual market and use what they’ve learned in real time to inform other initiatives and improve upon existing projects.

Gain Access to Industry Expertise

Fintechs, by definition, seek to improve and automate the delivery of financial services by combining finance and technology. As such, it's part of their existence to learn and know as much as they can about the niche sectors they serve. To continue the ERP example, FISPAN's founding principle is that they saw a gap in the market between ERP systems and banks, and have worked to close that gap by connecting a number of ERP systems to a number of banks. In doing that, they have seen the good and the bad, the advanced API journey, the not-yet-started API journey, and the middle of the road API journey. They’ve also learned from both sides: the ERP business platform side and the bank side. When a Fintech has the staff and resources to focus on one aspect of the business, they can quickly become subject matter experts in that area and share that knowledge and best practices with their banking partners. In FISPAN’s case, this means referring to connectivity and making any type of connectivity work between API platforms, ERPs, and Banks.

Fintechs, by definition, seek to improve and automate the delivery of financial services by combining finance and technology. As such, it's part of their existence to learn and know as much as they can about the niche sectors they serve. To continue the ERP example, FISPAN's founding principle is that they saw a gap in the market between ERP systems and banks, and have worked to close that gap by connecting a number of ERP systems to a number of banks. In doing that, they have seen the good and the bad, the advanced API journey, the not-yet-started API journey, and the middle of the road API journey. They’ve also learned from both sides: the ERP business platform side and the bank side. When a Fintech has the staff and resources to focus on one aspect of the business, they can quickly become subject matter experts in that area and share that knowledge and best practices with their banking partners. In FISPAN’s case, this means referring to connectivity and making any type of connectivity work between API platforms, ERPs, and Banks.

Outsourced Client & Product Servicing

We’ve established that Fintechs can be the subject matter experts of these new digital integrations, providing essential knowledge as banks navigate through various API applications. In many cases, the bank's digital strategy supports a white label approach to implementation, allowing the bank to be the main point of contact while collaborating with the Fintech behind the scene to ensure the integrations function and perform as intended. Here, banks certainly have the opportunity to be trained by the Fintech company to provide the necessary client-facing servicing of products and services required. However, the opportunity also exists to outsource client and product servicing to the Fintech to provide ongoing support of the platform post integration.

We’ve established that Fintechs can be the subject matter experts of these new digital integrations, providing essential knowledge as banks navigate through various API applications. In many cases, the bank's digital strategy supports a white label approach to implementation, allowing the bank to be the main point of contact while collaborating with the Fintech behind the scene to ensure the integrations function and perform as intended. Here, banks certainly have the opportunity to be trained by the Fintech company to provide the necessary client-facing servicing of products and services required. However, the opportunity also exists to outsource client and product servicing to the Fintech to provide ongoing support of the platform post integration.

Overall Accelerated Time to Market

As the saying goes, you could walk from New York to LA or you could drive or fly. You’ll get there, but the route you take really matters.

Driving technology innovation in any industry is difficult. Add in the complexity of IT budget approvals, state and federal regulation, employee training programs, archaic technology infrastructure, and the standard bureaucratic bank processes, you can see why innovation in the financial services industry is nearly impossible.

Banks can leverage complementary FinTech players as new distribution channels for banks’ products and services. Fintechs, working as experts in their niches, gain a lot of industry experience and learnings which includes experience in all aspects that delay or accelerate a project and can bring that expertise to your banking integration.

Bottom Line

Bottom Line

Through a Fintech’s core focus on building strong partnerships with business banking teams to help deliver embedded banking solutions to their clients, partnering with the right fintech is truly a new way for the banks to better service and retain high value customers.

“Our belief is that we truly are a partner of our bank clients. We're not simply a vendor or a software provider. We are a partner that opens up a new channel of communication and revenue for our bank clients to their corporate clients. We really see ourselves as an addition to banks' existing capabilities and services.” Claire Robinson, VP of Product, FISPAN

To learn more about the Banking - ERP ecosystem and how banks can benefit through FISPAN’s integration, check out our on-demand webinar, Friend or Foe? 5 Ways Fintechs, APIs & ERPs Unlock Hidden Business Banking Revenue. To learn more about how the FISPAN - ERP integration works, schedule a quick demo here.