Why Embedded Banking is the Key To Building Personalized Experiences

Embedded banking and personalization go hand in hand and banks should consider embedded banking as a way to build a customer-centric strategy.

The Rise of Hyper-Personalization

From “Made For You” Spotify playlists, your Amazon shopping trends, to Netflix viewing recommendations, we’re living in a data-driven world where our every decision triggers a suggestion based on our individual interests and motivations. Personalization has also permeated the corporate world, where data is helping businesses provide their customers with smarter recommendations and customizable offers. Vendors are using algorithms to track customers’ purchasing data and identify any fluctuations, triggering a price adjustment or extended line of credit before the customer even asks. This has become the norm in our digital world. In fact, experiences that don’t involve any type of personalization in consumer touchpoints are becoming harder to find.

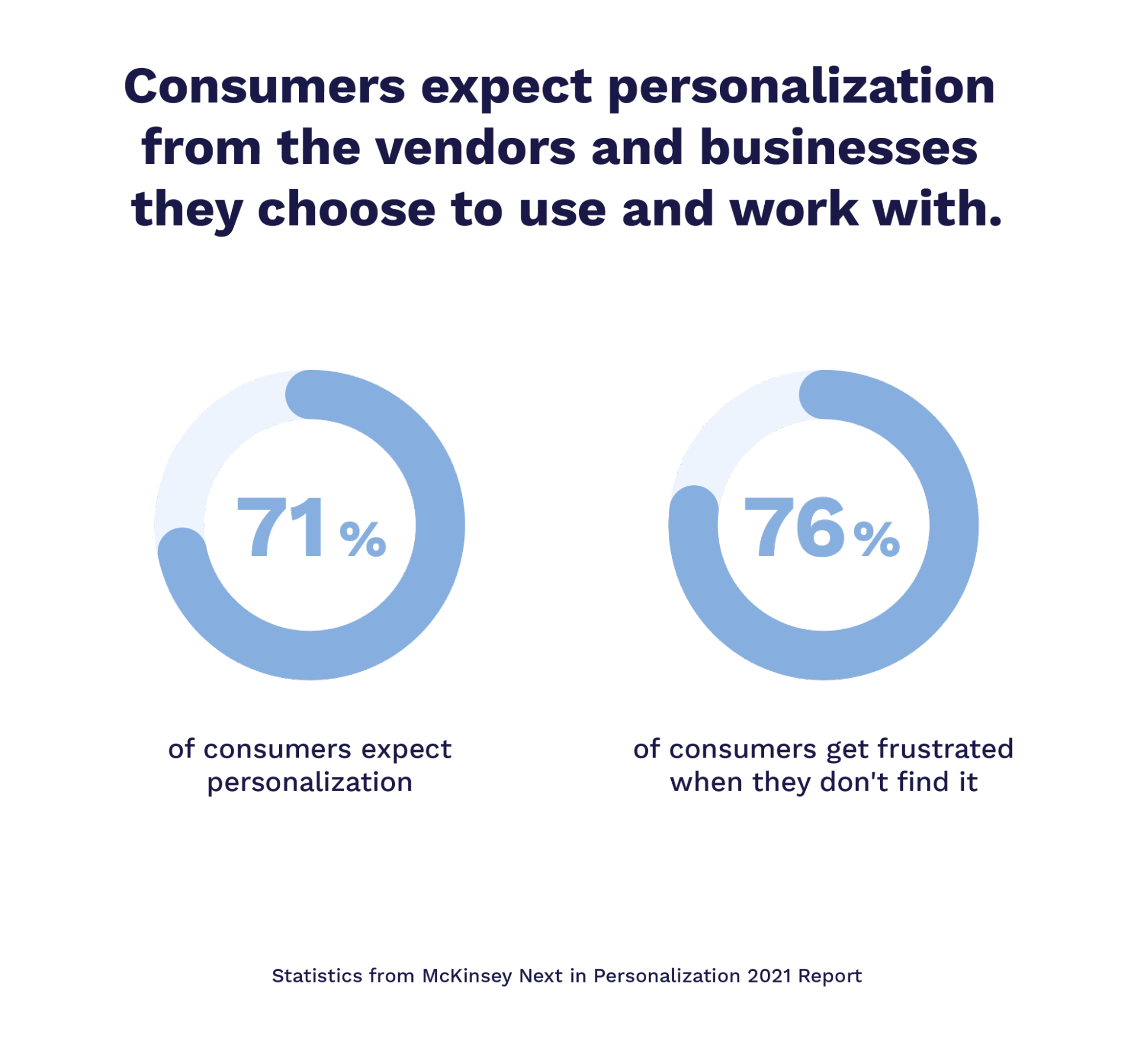

Technological capabilities have skyrocketed in recent years, bringing an increase in customer expectations along with them. Personalized experiences matter more than ever, with one McKinsey study showing that 71% of consumers expect companies to deliver personalized interactions, with 76% becoming frustrated when it doesn’t occur.

While the entertainment and retail industries have so far taken the lead in the personalization revolution, their practices have fundamentally altered overall consumer behaviour. Soon, every industry will be shaped by customer expectations of hyper-personalization. This expectation has also trickled down into the financial services sector.

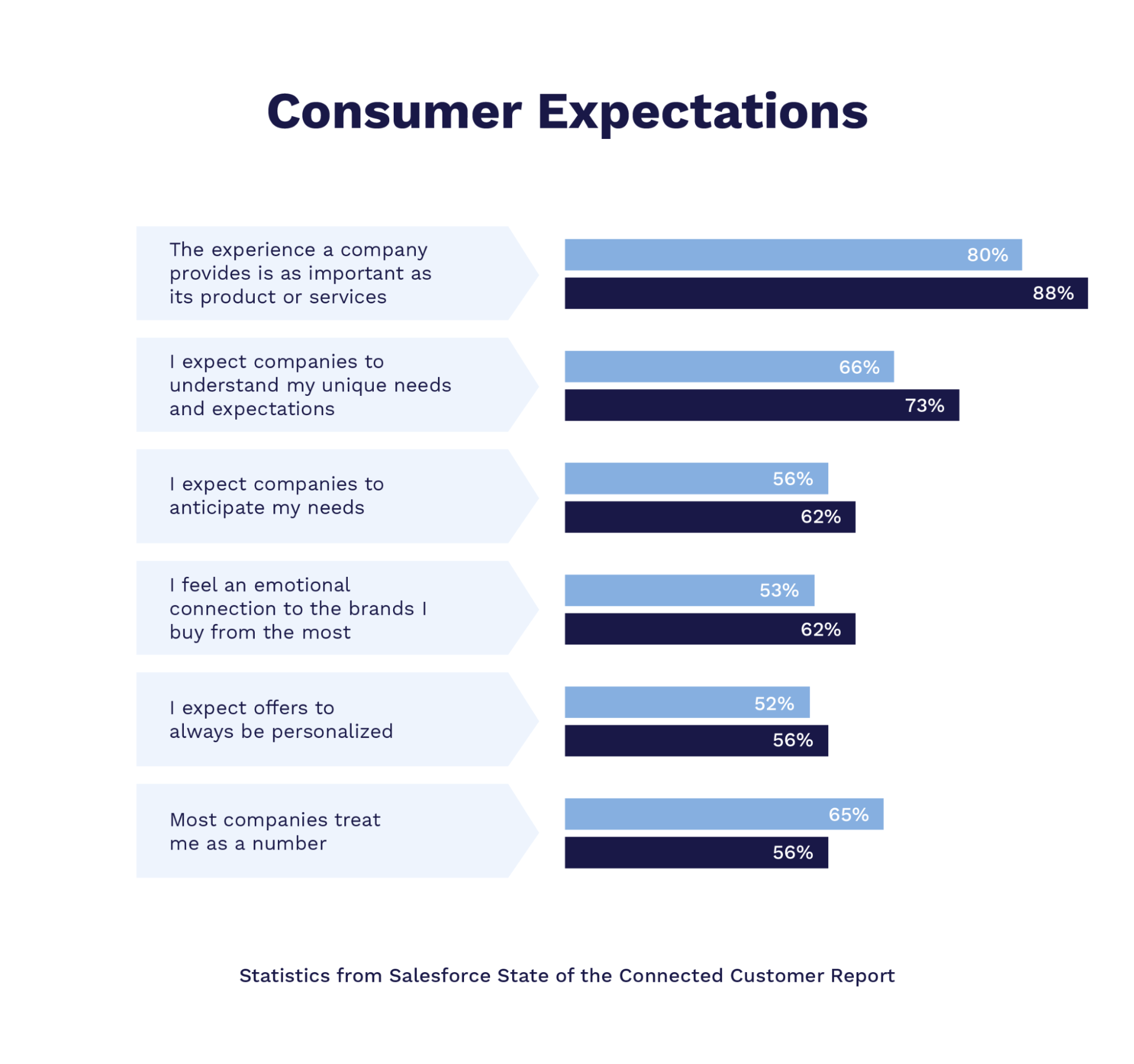

Corporate customers are no longer satisfied with the status quo, instead seeking out services tailored to their unique needs. To keep up with shifting demand, banks need to innovate in ways that keep them accessible and valuable to their customers. As a whole, the financial services industry must prioritize customer-centric initiatives that deliver maximum value.

The Need for More Personalization in Commercial Banking

Digital capabilities are no longer a differentiator in today’s banking experience. Customers have grown accustomed to deeper, more nuanced services like multichannel access, seamless integration and “segment-of-one” targeting. They want a bank that anticipates their needs before they even pick up the phone or open an app.

The demand for personalized banking experiences has skyrocketed, proven by a 2021 capco study that found 72% of respondents identifying personalization to be ‘highly important’ in today’s financial landscape. That same survey found that 79% of millennials - our emerging generation of business leaders - are the ones that place the highest value on personalization.

Despite these findings, banks continue to fall further behind in delivering these experiences. In a 2021 Financial Brand survey, it was found that fewer than 1 in 5 financial institutions feel they are prepared to deliver personalized experiences at scale. While traditional banks try to keep up with the rising demand, they must also compete with emerging neo-banks, or else risk losing their long-term customers. FISPAN’s blog post “How Banks Can Protect Themselves From Losing Customers” dives into the different ways banks can successfully retain their commercial clients.

Historically, banks have focused more on pushing intricate product offerings and services than on understanding each client’s unique needs. To succeed in a personalized world, banks must flip that traditional product-focused model on its head and become truly customer-centric. This means that the customer needs to be at the focal point of decision-making. The development of products and services must cater to their requirements and expectations.

A lack of customer-centric innovation could come back to haunt banks in the face of an expected economic downturn. When corporate customers lack the solutions they desire, their business will go to the financial service providers who deliver the most valuable insights and customized solutions. This leads to increased opportunities in multiple markets and demographics, with 81% of Gen Z respondents signaling that personalization would deepen their financial services relationships.

Simply providing the technology isn’t enough — businesses need personalized analysis, insights and suggestions. Fortunately, banks are sitting on piles of pertinent information, including payment history, customer journeys, performance metrics and financial forecasting. Unfortunately, most institutions haven’t yet found a way to connect the dots between this data and the services they provide. Within this gap enters a new opportunity - contextual banking.

Building a Customer-Centric Strategy with Contextual Banking

While the services banks have provided over the last few decades remain relatively unchanged, technology has radically altered how, where and when customers use those services. With the advent of the smartphone, banking services are now available at the touch of a screen. The majority of banking applications have faded into the background of our everyday lives.

Now that physical branches are no longer at the center of engagement, the ability to understand customer needs has become increasingly more important — and more complex. A customer-centric approach starts with actually putting the customer at the center of the banking process, wherever they are and whatever their circumstances. The biggest opportunity for banks right now lies in providing customers with the right services at the right time.

.png?width=436&name=How-to%20be%20Customer%20Centric%20(1).png)

Contextual banking is defined as a financial services model that offers real time insights and recommendations tailored to each customer’s unique needs and circumstances, sort of like a financial advisor in your pocket.

How Does Contextual Banking Work?

The industry hasn’t reached full contextual banking capabilities — yet. Embedded banking is the foundation upon which contextual banking must be built.

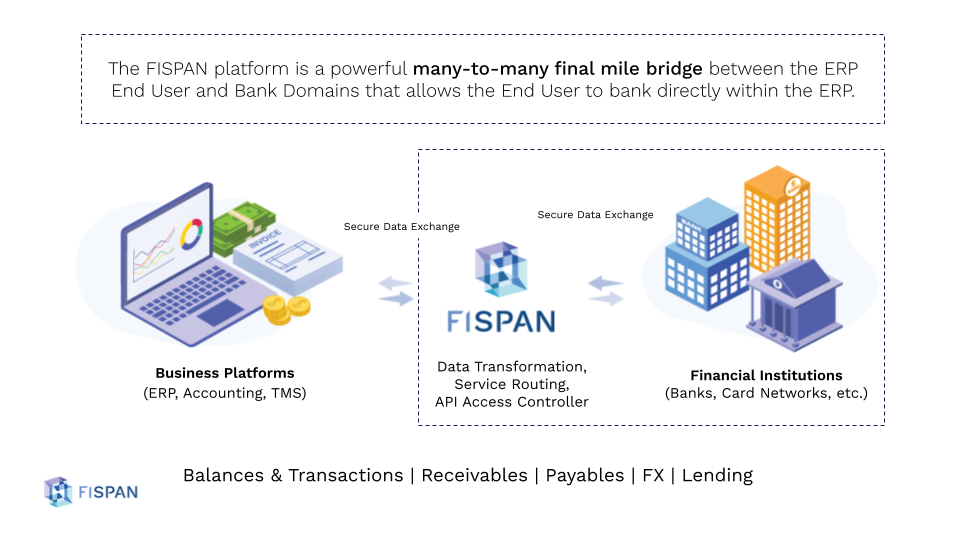

Embedded banking is the integration of banking services directly within a company’s existing applications and platforms. This banking integration allows access to banking services and products directly within the accounting systems or ERP that a company uses on a day-to-day basis.

Contextual banking takes embedded banking a step further — from integration to prediction. For example, a contextual banking algorithm might notice a corporate customer’s account is running low but, based on past cash flow history, know the customer is due for a payment soon. In this case, the system could automatically extend a line of credit before the customer is even aware of the low balance.

FISPAN’s contextual business banking platform enables banks to offer the same commercial banking services, except they are now embedded within ERP and business applications. With partner banks, FISPAN delivers a best-in-class commercial banking experience by removing payment and operational friction while adding value to how clients operate their business.

The contextual banking experience both enhances the customer experience and increases ROI for banks. You can learn about open treasury and the ROI for both banks and commercial clients in our on-demand webinar with new insights from Celent, a top-tier analyst firm. With contextual banking, customers receive truly relevant promotions, recommendations, advice and predictive insights. Meanwhile, banks gain the opportunity to upsell and cross-sell applicable services, turn untapped data into actionable analysis and identify trends that position them as industry leaders.

Benefits of Contextual Payments

Context is important when it comes to corporate payment services, which reveals the opportunity for contextual payments. With contextual payments, banks are able to further understand what clients are able to achieve, and then recommend the best way forward. Instead of focusing on execution and product, banks can now bring their attention to the context in which payments are made.

Contextual payments showcase the optimal routes with consistency and efficiency, and integrating this service, along with contextual banking, can not only make your clients more satisfied as a seamless experience, but can bring you higher efficiency and revenue internally.

The commercial banks of the future will integrate seamlessly into their customers’ workflow and provide frictionless support in real time. They’ll move from digital enabler to context connector, identifying needs on a situational basis.

Privacy and Transparency

Today’s people and businesses are increasingly more comfortable sharing their data in exchange for products and services that deliver real value. At the same time, they’re increasingly wary of organizations that misuse that data for their own gain. Contextual banking relies on data to make personalized recommendations. To use this information responsibly, banks must embrace transparency as one of their core values and establish a culture of trust. All exchanges of data between a financial institution and its customers should be explicitly and transparently permissioned. While banks may be hesitant to embrace data transparency, the practice of sharing data in accordance with customer permissions can result in benefits for all parties, which we dive more into in our whitepaper “Data Transparency and The Transformation of Corporate Banking”. Similarly, customers deserve the right to keep some information private or change the privacy status of their data at any time.

Don't Worry, Your Job Isn't Going Anywhere

Contextual banking is a solution intended to be used in tandem with human financial experts — not replace them. When implemented correctly, this model will improve the banking experience for customers and financial managers alike. Contextual banking can create huge efficiencies that open up more time for bank executives to manage client relationships, in turn arming corporate customers with the information they need to innovate and succeed.