Embedded Banking's Top 5 Benefits for Finance Teams

Increased data visibility, reduced manual error, and improved automated processes are amongst some of the many benefits embedded banking can bring to your business. If your finance team is looking to minimize tedious and redundant work, embedded banking just might be the solution you’ve been looking for.

If you haven’t yet heard of or implemented embedded banking into your treasury management tools, you’ll likely want to after reading this article. As a burgeoning trend in the financial services industry, embedded finance will reach a global value of $7 trillion in the next 10 years, signalling that the best time to invest in embedded banking is now.

But First, What Even Is Embedded Finance?

Embedded Finance is the act of integrating banking services or tools into non-financial services. To put it into context, this could look like Enterprise Resource Planning Systems (ERPs), or the accounting software you use on a daily basis. The concept of bringing your banking activities directly into non-financial services is made possible through technology, leading to enhanced user experiences. For you, this could mean eliminating several pain points by streamlining your banking capabilities into your everyday work.

What’s pushing this trend ahead? Simply put, customer demand. Customers are no longer satisfied with outdated and manual modes of payment and reconciliation and are instead continuously pushing for new ways to improve their accounting and treasury management activities. Because of the acceleration of digitization and innovation, businesses are looking to their banks for digital solutions that can help them eliminate paper-based processes. This rising demand for a simple and holistic experience has helped pave the way for embedded finance.

Nowadays, the trust advantage that legacy banks once held above fintech companies is diminishing, thus forcing them to work quickly to meet the needs of their customers. For many banks, embedded finance has become a priority and is expected to account for over 15% of revenue share by 2030. Setting your business up for success in the future means having a digital forward bank who invests in the best technology for its customers. Hosting many benefits for corporate clients and banks alike, consider asking your bank if they offer embedded finance solutions for their customers (such as embedded banking) to kick-start that conversation.

What Are Some Examples of Embedded Finance?

Embedded finance can consist of embedded payments, embedded lending, embedded insurance, and embedded banking, which we’ll be discussing more throughout this article.

- Embedded Payments: Through embedded payments, consumers are able to pay instantly with the click of a button. In fact, you probably use embedded payments in your everyday life. Apps such as “Uber” utilize embedded payments where payment technology is integrated within the infrastructure of their app. This allows customers to pay automatically through the app, instead of inputting their card information every time. Embedded payments has since grown to encompass digital wallets such as Apple Pay and Google pay for more convenient customer experiences.

- Embedded Lending: Also known as 'Buy now pay later' (BNPL), embedded lending enables consumers to pay off their purchase through several periods instead of paying upfront immediately. For example, Afterpay lets a consumer split their purchase into smaller monthly payments without having to go to a bank and experiencing long waiting times.

- Embedded Banking: Embedded banking occurs where non-financial institutions are able to offer the same banking services that are traditionally provided by financial institutions. Companies who utilize embedded banking can enjoy a streamlined and seamless banking experience, where they can access the same banking capabilities in one platform.

Embedded Banking In Practice

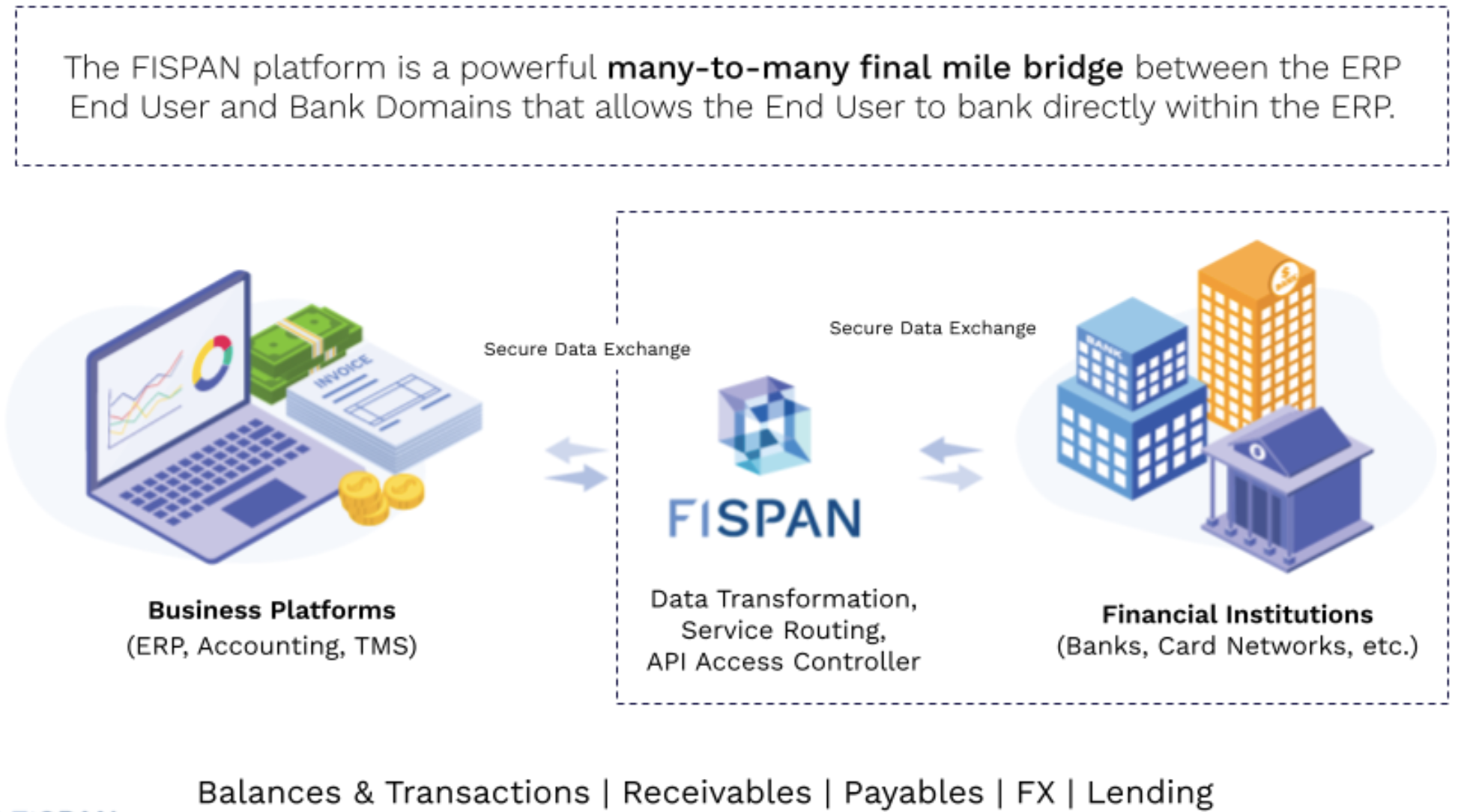

With embedded finance, comes the development of multiple applications like embedded banking to cater towards different business banking needs. Customers are looking for convenient, seamless experiences, and fintechs are leveraging their strengths to create the products customers are asking for. Here at FISPAN, we’re in the business of embedded banking and have built a two-way solution between the bank and the ERP, crafting a differentiated banking experience for end users.

FISPAN’s integrations allow banking products and services to be directly embedded into the platforms you use in a secure and user-friendly way, helping you remove friction in multiple touchpoints. Instead of using both your ERP and Bank to perform cash management, accounts payable, and accounts receivable activities, you can do it all through one portal, as our integration sends all the relevant information to your bank. Depending on the ERP and Accounting Software you might use, the solution can look a little bit different.

The Top 5 Advantages of Embedded Banking Solutions

- Automated Processes

The top focus of every finance team is arguably automation. Because their team is stuck dealing with endless manual tasks, the advantage of automation is a big motivator. In fact, a study from Sage Intacct showed that 60% of finance leaders reported that their current processes were challenging, with 45% being challenged with cumbersome administrative and manual tasks.

For finance teams, payments form a large part of their everyday work, and the act of navigating between their ERP/Accounting Software and their respective banking portal can add up quickly. When the banking experience isn’t integrated into their native software, the process can be downright frustrating. To paint a better picture, we can use the example of payment processing. Without an embedded banking solution, finance teams usually plug in all the information within their ERP, then must login to the bank in a separate portal, input the necessary information, and upload the relevant documents before the payment is made. We’ve even discovered that many corporate clients are experiencing extremely manual and time consuming tasks when it comes to ACH payments, as they would initially process the payment within their ERP then go to the bank to release the payment.

As you may see from this example, there are many steps that must take place just to make a payment, and FISPAN can automate this process for you. Instead of navigating between portals, FISPAN comes in and sends that information to the bank once the payment is made within your ERP. This allows the payment to be made in real-time. By eliminating redundant steps within processes such as payables, FISPAN can give your finance team their time back so they can spend it on more strategic tasks, demonstrating how it can also lead to increased productivity. - Increased Data Visibility

Let’s face it, data visibility is incredibly valuable for all organizations, allowing teams to make more informed decisions, identify risks, and answer questions more quickly and efficiently. Data visibility refers to both the ease of access to data as well its accuracy, helping companies monitor and display data from different sources. In a 2021 PYMNTS panel discussion featuring FISPAN Co-Founder Lisa Shields, they discuss how embedded banking can help corporate treasurers gain financial visibility through a unified platform.

With the FISPAN plug-in, your team can achieve better data visibility and information reporting. What do we mean by this? Each finance team is able to see all the different bank accounts and their activity directly in one screen, right when they log into their ERP. These bank accounts are updated on a regular basis, though its specific cadence is bank dependent. These automatic bank feeds help finance teams check their cash flow easily and more efficiently with access to live data.

This ease of data access is central to the FISPAN experience, as teams gain increased visibility to data without leaving the comfort of their ERP - ultimately leading finance teams to make more data-driven decisions and answer any questions without having to look in different environments. - Reduced Manual Error

Manual errors are easy to come by when you utilize manual accounting and finance systems - one misclick can severely impact your company. It could even result in a $1 billion dollar mistake for some, as noted in the 2021 event where a clerical error from Citigroup’s credit department sent almost $1 billion to Revlon Inc,’s lenders.

When you rely on human accuracy in accounting, it can be naturally prone to errors, which can be hard to take back once it’s been made. Some common errors include not saving work, mistyping fields, and misinterpreting data, to name a few. In banking, many accountants and bookkeepers must download files from the ERP to upload into the bank portal, and input information from the ERP window into that of the banks. This leaves much room for input and formatting errors, as uploading the wrong file could negatively impact accounts. Reducing this manual error can be made possible through various integrations, such as Zapier who integrates accounting software directly with other tools “native integrations”. With FISPAN, because updates are made in real-time and open bill payments can be made automatically, this leaves less room for errors to occur. - Streamlined AR/AP Reconciliation

Whether you perform your bank reconciliation on a weekly or monthly basis, chances are that it is a tedious process. It’s clear that AP/AR needs to be digitized, with 83% of CFOs citing that reduced costs and improved efficiency are key benefits of AP/AR digitization. One bookkeeper even shared that their monthly reconciliation process could take up to 4 hours, and would manually import each transaction and its relevant file.

With the FISPAN integration, users are able to export each file straight in the plug-in. Using one login, bills are able to be paid and reconciliation can occur easily as the automated bank feeds can be accessed directly from the ERP, thus bringing the corporate user more information and allows for auto-reconciliation. Read more about how FISPAN can help streamline your treasury management workflow in this blog post.

- Guaranteed Security

With the rise in digitization comes increased security concerns from individuals and businesses alike. In a 2022 HelpSystems Report, 35% of survey respondents stated data security has significantly increased as a priority.

At FISPAN, security is at the forefront of our operating practices. We provide secure and stable connectivity from initial implementation through to on-going maintenance, with users able to set their own data permissions.

FISPAN….

-

- Is ISO 27001/27002 Certified (which means we adhere to the highest standard of organizational information security standards and information security management practices)

- Is SOC 2 Type 2 Compliant (which means we follow strict information security policies and procedures encompassing the security, availability, processing, integrity, and confidentiality of customer data)

- Provides 99.99% Historical Availability (which means that our platform is built to facilitate compliant, verifiable, and trusted transactions between banks and their customers)

Revolutionizing the Accounting Journey

It’s time for change to occur for accounting and treasury management teams, who have always struggled to automate time-consuming processes and reduce manual errors. These customers require innovative banking products and services, which can be only made possible through embedded banking. Luckily, this is becoming more common. In a 2022 PYMNTS & FISPAN report, data shows that 9 out of 10 financial institutions are pursuing or planning to pursue embedded finance solutions to address these frictions experienced by banking customers.

As more fintechs such as FISPAN join the push to revolutionize the customer experience, finance teams are finding a large amount of value in these products, which is bringing FISPAN one step closer to our vision. From the elimination of redundant tasks, better data visibility, and streamlined payment and reconciliation processes, FISPAN is forging onward in our journey to revolutionize accounting as we know it.

________

Want to find out how FISPAN can help your team save both time and money? Book a demo or watch this explainer video to see how it works.