How to Leverage ERPs When Selling Treasury Services

Banks understand that in order to attract and retain customers, they must be convenient and provide branch offerings close to where their clients live and do business. Several decades ago, banks even had mobile branches that would quite literally drive to their customers, city by city, state by state, to ensure that they deliver on their commitment to providing exceptional customer service.

Fast forward to today, and banks have ditched the automobiles and instead, deliver their services through the power of laptops, smartphones, and even the smartwatch. So, what does this mean for treasury and commercial banking? Can banks do better? Can you embed your services even deeper into the lives of your client base? Yes, you certainly can!

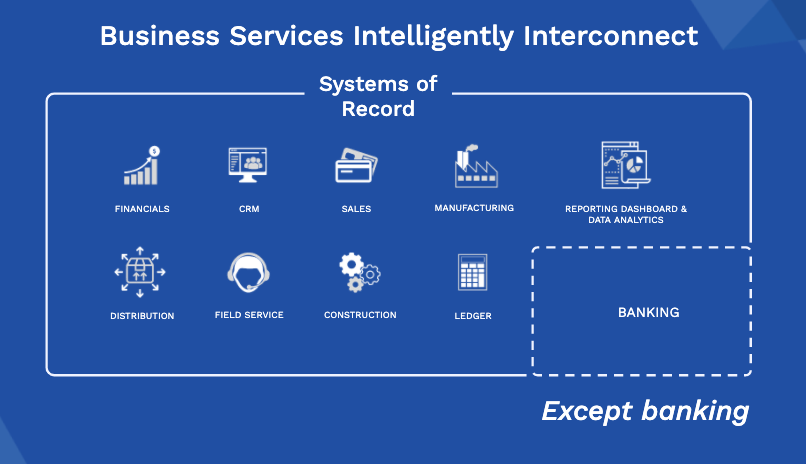

In fact, within the world of corporate banking, there remains a largely underutilized channel of delivery that most banks are yet to embrace - ERPs.

As unfathomable as it may seem, your corporate clients have a life beyond your banking portal. In fact, for your corporate customers, where they truly live and breathe is within their ERP (Enterprise Resource Planning) system - this is where they run their business - and this is where you need to be. This is the bank branch of the future.

Accenture reports 55% of companies are not satisfied with their firms’ payments and treasury banking capabilities, and 90% of treasurers expect to see a change in their treasury’s technology - yearning for innovation that’s both operational and cost-efficient while improving the visibility of their cash flow and accounting.

Accenture reports 55% of companies are not satisfied with their firms’ payments and treasury banking capabilities, and 90% of treasurers expect to see a change in their treasury’s technology - yearning for innovation that’s both operational and cost-efficient while improving the visibility of their cash flow and accounting.

Evidently clients’ expectations are changing. Delivering a treasury experience within your clients’s ERP doesn’t just meet their expectations, it goes above and beyond.

Take NetSuite for example, a leading cloud-based mid-market ERP system. Today, a business using NetSuite can go and download an application to simplify their functions across various internal operations but that does not hold true today for business banking. Today corporate finance departments are desperately looking for ways to easily access the following banking services within their ERP system:

- Information Reporting/Reconciliation

- Integrated Receivables

- Streamlined Payments Process

- And just about any other Treasury Service that could feasibly be embedded inside your clients ERP

So the question remains, how can you be smart about ERPs when selling your Treasury Services?

First and foremost, understanding your clients’ pain point(s) is crucial. Manually shifting data in and out of an ERP into the banking portal is tedious and time-consuming. Reconciling bank accounts is an error-prone process that is burdensome - According to a Forbes article, accounting staff spend 90% of their time completing reconciliations, leaving only the remaining 10% to actually analyze the implications of their reporting. A lack of visibility into the payment process between the ERP and bank systems is a problem that is far too familiar to your clients. In fact, consider the following analogy. I could have rented any movie from a Blockbuster store; a lack of choice was never an issue. But give me even a fraction of that choice through my Netflix account from the comfort of my couch and the game has been changed forever. Now, instead of going to the Blockbuster store for movies, not on Netflix, I’m simply going to demand they be uploaded to Netflix instead. This is exactly how corporations feel today about Treasury services - “I already have my Netflix account (my ERP), now can you please upload the movies (treasury services) that I want?”

Second, let’s understand what is actually managed in your clients’ ERP and how your Treasury services can leverage that information. Invoices, vendor records, recipient banking details, historical and future AP & AR data, and cash flow reports - all of these components provide context around your clients’ business that you don’t already have today. Why is your client paying that bill? Why is that vendor critical to their operations? What does the next week, month, or quarter look like for your client from a cash perspective? Having the answers to some or any of these questions will better equip you to further personalizing and advancing your current products and services. And you can collect the right information to better cater to your clients only if you’re able to maintain a treasury experience directly within their ERP system.

Thirdly, understand how you can actually solve these problems. Yes, data feeds are great. Yes, bi-directional connectivity is necessary. But what should your clients’ experience fundamentally look like? Embedding bank-branded applications inside your clients’ ERP systems not only provides them with the bi-directional connectivity they require but also the user interface that will fundamentally transform the way your clients bank with you.

So let’s say you’re on board. You’ve acknowledged that you need an ERP presence for your treasury department - where do you go next? Access any modern ERPs development partner ecosystem and you’ll be inundated with a plethora of options - numerous third-party developers that at first glance, all seem to be offering cookie-cutter solutions. At this stage, you need to narrow down your options so ask yourself the following questions. What revenue/business model is conducive to the business of my bank? How much control do I have over the client experience? How much work do I, the bank, actually have to do? Which option will spare me the wrath of my compliance department? Demand these answers, and you’ll find your ideal partner sooner than you think.

Lastly, and by far the most difficult, understand the nuances. Not all ERP systems are built equal. ERPs differ massively in their capabilities, technical build, deployment methods, workflows, UX & UI and much more. This matters immensely. Your client base isn’t monolithic/homogeneous, nor are their ERPs. In fact, there’s a good chance that amongst your client base there are over 100 ERPs currently in use. Even within individual ERP vendors, products can vary immensely. For example, Microsoft ERPs are not all built on the same code language or framework - likewise, Oracle’s ERP offerings all have nuances on how they can be deployed or how clients choose to deploy them. For any given ERP, there exists a unique versioning & update schedule/pattern, which, when scaled across the market, results in 1000s of outcomes. Ultimately, the conversation that you need to have with your clients or prospects using NetSuite, cannot be copied verbatim for Sage Intacct, or Microsoft Business Central 365, or any other ERP for that matter. You need to understand the minute details to speak your client’s language, as all salespeople do, regardless of what you are selling.

Each of the four points raised above could, in and of itself, be an entire whitepaper, let alone individual blog posts but hopefully, you’re better prepared to navigate this space now than before. Today every bank is seeking innovative ways to remove friction between them and their customers. Early adopter banks that leverage more convenient channels to help improve customer experience are sure to be the leaders of tomorrow.

__

Still have questions? Watch our Strategic ERP & Banking Workshop Webinar (on-demand) or contact us today for your personalized demo.