5 Examples of APIs in Banking

The transformation of the digital world is well underway thanks to the use of APIs, but what does this mean for the financial services industry? Read on to see how APIs have helped to build a more accessible and convenient customer experience, and how it has helped with connectivity and integration for financial institutions.

Financial APIs have enabled the transformation of the banking customer experience which is critical for success. With an increased demand from consumers for digital solutions such as banking applications, banks need to leverage the use of financial APIs as a way to add new revenue streams, and access to customer data, as well as encourage innovation. Fintechs and financial institutions alike are using financial APIs to tackle this widespread opportunity; consider this: 91% of users would rather use the banking app than go into the bank. Nowadays, APIs have even expanded to produce API-as-a-product companies such as Stripe with its foray into payments.

What Are APIs?

In a nutshell, Application Programming Interfaces (APIs) allow applications to communicate with one another. Through APIs, various services and products are able to interconnect, leading to a secure and easy data exchange. APIs have completely shifted the future of software development and innovation, as companies are able to open up their data to external developers and partners. New and unique applications can then be developed using other firm’s data and pre-existing technology. These days, reliance on APIs continues to grow rapidly. 90.5% of developers predict to use APIs in the same amount in 2022, if not more, as compared to 2021. Think of it like an interface, except for software.

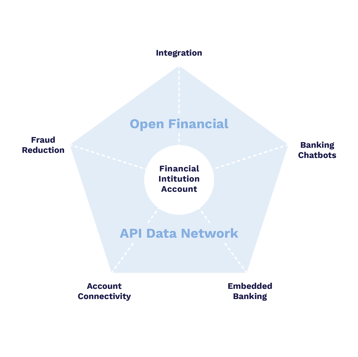

Financial APIs enable the creation of a whole ecosystem of financial services by providing the data and connections that it requires, unlocking value at every touchpoint.

APIs Throughout The Years

The history of APIs can be traced back to almost two decades ago. Between the years of 2000-2002, online commerce had just launched and three key companies, Salesforce, eBay, and Amazon, identified an opportunity to make their information and data readily available and shareable. Many people actually consider the first modern API to come from Salesforce, who capitalized on this realization and first released their API in 2000.

The Modern API

Post 2002, API use has grown dramatically to extend into many areas, not just in the e-commerce space. Facebook launched an API that enabled developers to create quizzes and games from its access to large amounts of user information that wasn’t previously seen before. Today, the modern API can be characterized by 4 specific attributes:

- It follows standards that are developer friendly and accessible

- It acts more as a product rather than just code

- It is standardized

- It has its own software development lifecycle

Using APIs as an Advantage

The concept of allowing apps and systems to communicate with one another using APIs can seem daunting, especially for a user with personalized information on said applications. However, because user data on the phone is communicated using small sections at once, the server only processes necessary information and phone data is never fully exposed, revealing how APIs can actually provide a layer of security.

With the growth in API use over the past two decades, it’s becoming more evident that APIs can have added benefits for many organizations, encouraging the creation of innovative products and services. The added flexibility that APIs offer can allow companies to launch into new markets with new services as well as target existing markets with improved features. At FISPAN, we integrate with partners to develop their APIs so that financial institutions can meet changing consumer demand. Our blog post, “FinTechs Are Friends, Not Foes,” expands on the benefits of partnering with third parties like FinTechs (and FISPAN).

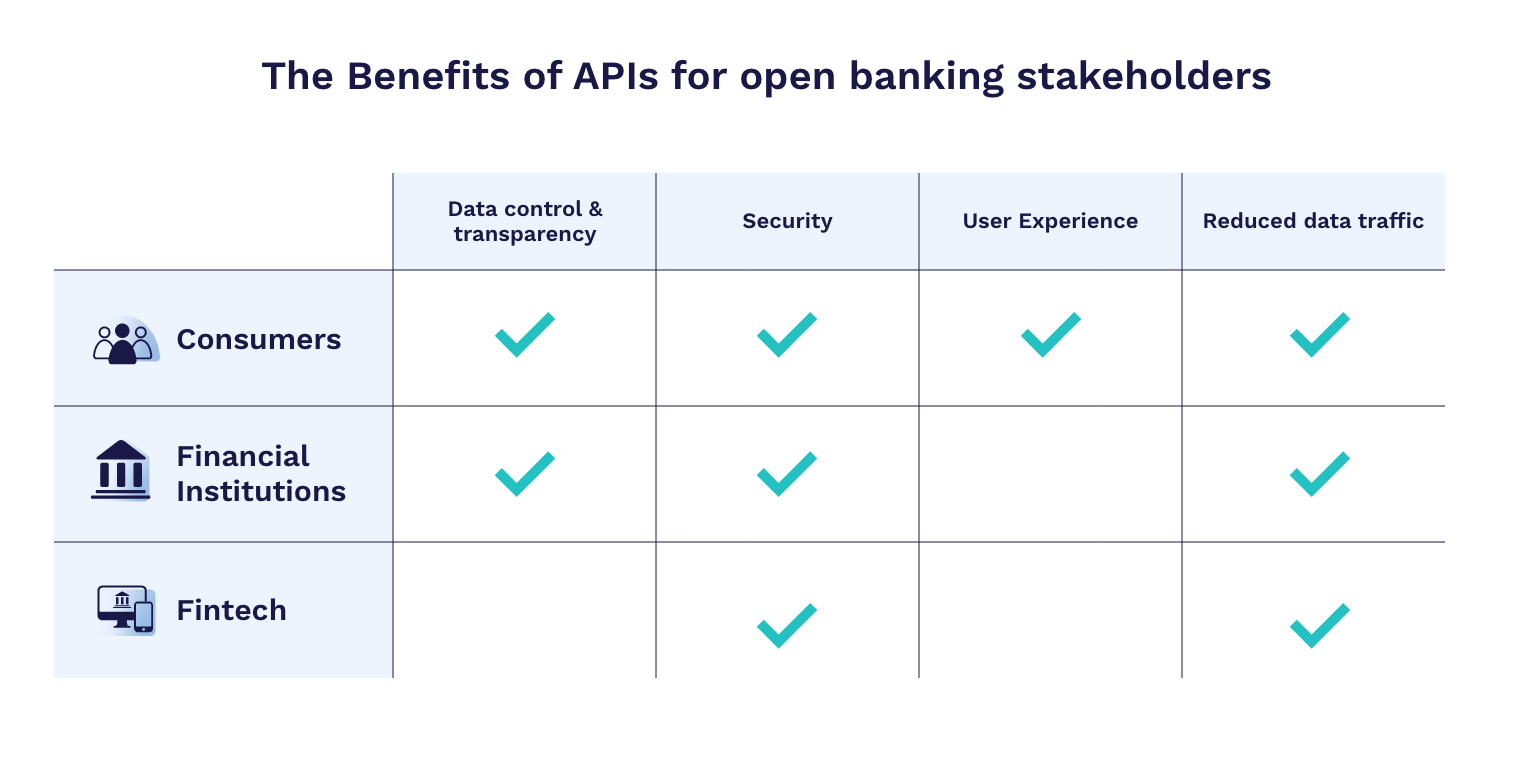

For financial institutions, the benefits of APIs also expand to increased engagement. Because of a more simplified customer experience with fintech partnership, banks realize more transactions and payments that take place as a result.

Mixing Banking & APIs Together

There exist many uses for APIs, as they act as a way for companies to launch new services, speed up product development, and connect with developers. For a company, APIs can even contribute towards a large part of business revenue, take Google, eBay, Amazon, and Salesforce for example.

There exist many uses for APIs, as they act as a way for companies to launch new services, speed up product development, and connect with developers. For a company, APIs can even contribute towards a large part of business revenue, take Google, eBay, Amazon, and Salesforce for example.

APIs unlock many different opportunities and doors, and one critical opportunity being tapped into is the future of their significant connection to open banking. When these two worlds collide, huge benefits are realized in terms of innovation and financial income. With APIs increasingly being seen as drivers of new revenue, financial institutions are taking note; over 90% of financial institutions use or plan to use APIs to generate additional revenue among their customer base.

Financial institutions are able to provide third-parties, such as FinTech companies, access to consumer data and APIs in a secure manner with open banking. With access, third-parties can develop additional, improved banking products and services in a shorter period of time. Open banking protocols have helped kickstart the automation of different banking services that are much needed and demanded from consumers today. API implementation helps with the development of those products and services. Acting as a leeway for data transmission, banks can leverage the use of APIs to offer a streamlined customer experience that helps to solve different consumer pain points.

The financial services industry is benefiting greatly from API use, and it has revolutionized the way in which commercial businesses approach banking and payments. Here are 5 ways in which APIs have been integrated in the banking industry.

5 Examples of APIs in Banking

- Banking Chatbots

APIs are used behind banking chatbots, which are able to converse with customers to solve different problems in an intuitive way while real human agents can focus on more complex issues. FINN AI, a Vancouver-based fintech, is taking advantage of Visa Developer Platform APIs to bring a more personalized and convenient banking experience for customers. This access to new databases and account information undoubtedly helps enhance their existing conversational AI technology that powers their chatbots created specifically for financial institutions. What exactly does this entail for customers? They can now easily chat with a virtual assistant for different problems such as misplaced cards. - Integration

It is likely that older institutions operate on legacy systems and code, which are now becoming more difficult to integrate into a new ERP or CRM system. Though these legacy systems rarely communicate with newer technologies that have emerged, it is extremely costly, not to mention time-consuming, to replace or even build upon those existing systems. However, banks and other financial institutions can utilize cloud-based open banking platforms to integrate API solutions, potentially saving both time to market as well as savings in terms of internal resource requirements. APIs help bridge that gap by acting as a translator between the two systems without adjusting older legacy code. - Embedded Banking

With banks striving to meet their customers where they live, embedded banking is a key solution that uses APIs to bring the banking experience directly into an organization’s ERP systems that are used on a day-to-day basis. Business banking has long been difficult to consume and solutions such as embedded banking play a key role in strengthening business to bank relationships. FISPAN integrations allow banking products and services to directly integrate into user platforms in a secure manner through the use of financial APIs, resulting in a new and more streamlined commercial banking experience.

- Account Connectivity

REST APIs can provide real-time connectivity, allowing customer information to be pulled in real-time with a click of a button. The ability to quickly pull information acts as an advantage for both consumers as well as institutions due to its convenience. Quicken, for example, pulls information from the bank by logging in as that user but the API connection only pulls what it needs and what it is allowed to have access to, rather than all the information. - Fraud Reduction

The COVID-19 pandemic has accelerated digital banking habits among consumers, leaving more targets for financial fraud. Identity APIs can help reduce fraud risk dramatically through identity checks, where the identity API can check onboarding inputs against information that it can retrieve from a connected account. Verifying data from name, address, and contact information, the use of an identity API from the trading app Metal has helped prevent 5000 cases of fraud, totalling over $75,000. This was done by checking their “know your customer” data against the data their customers had already provided to their connected financial accounts.

Reinventing The Future with APIs

No matter which way you spin it, the world is interconnected through applications and software that depend on APIs. APIs have completely changed the way we interact with technology, especially with the huge amounts of transformation seen in the financial services industry.

What was once a closed industry that was slow to growth has become a landscape characterized by new financial user experiences, and it’s all thanks to APIs and open banking. Because banks can open customer data in a secure manner, control of the user experience has now shifted to partners and developers instead of banks to create added value, so that banks can instead focus on what they do best. As we move into what the rest of the future has to hold, it is without a doubt that the future of banking has changed, for the better, as a result of APIs.

If you’re interested in how FISPAN can support you to leverage APIs and embedded banking sooner rather than later, contact us today to learn more.