Reimagining Possibilities: SVB - A Division of First Citizens Bank

Today we had the chance to sit down with Savit Pirl, Managing Director overseeing Digital Payments, Lending, and Automation for Silicon Valley Bank (SVB), and Lisa Shields, CEO of FISPAN.

An introduction to our speakers:

Savit Pirl is the Managing Director overseeing Digital Payments, Lending, and Automation for Silicon Valley Bank (SVB), overseeing client interactions in the bank's digital area, particularly relating to money movement and credit lines. Before this, he served three years as the Head of Payment Transformation at PNC, where he helped build its payments hub. Savit began his career as a Systems Engineer at La Salle Bank, which later became Bank of America, where he rose to become Channel Head of Global Payments over an 18-year tenure.

Lisa Shields, much like Savit, made a career transition from the realm of engineering to the exciting field of payments at the turn of the millennium. She initially founded Hyperwallet, a pioneering payment solutions provider. Under her leadership, the company thrived and was eventually acquired by PayPal, marking a notable success in her entrepreneurial journey. Not one to rest on her laurels, Lisa then went on to establish FISPAN. This cutting-edge fintech venture specializes in seamlessly integrating financial institutions—including SVB—with the ERP systems of their clients. By bridging this gap, FISPAN aims to create a more efficient, secure, and user-friendly financial ecosystem for businesses.

Lisa Shields: SVB Go Link is an example of how SVB is supporting the innovation economy. How do you describe this ERP connector in the context of your offerings?

“We specialize in helping our clients grow and supporting their journey from that man or woman working in their garage, fostering an idea and to try and make the world a better place, [...] to a successful business that runs and perhaps get acquired by somebody else.” - Savit Pirl

Early stage startups often have little experience with treasury management. But as their company grows and they hire staff, get more and more suppliers and customers, they start to feel the need to move from Web Tools (SVB Go) into using other software systems like QuickBooks, for example. Their accounting tasks become increasingly complex.

“Clients require solutions that liberate them from the time-consuming tasks of managing bills and paying invoices:‘swivel chair accounting.’ Frankly, these clients would prefer to focus on innovation and their own products, and that's precisely where our partnership with FISPAN comes into play.“ - Savit Pirl

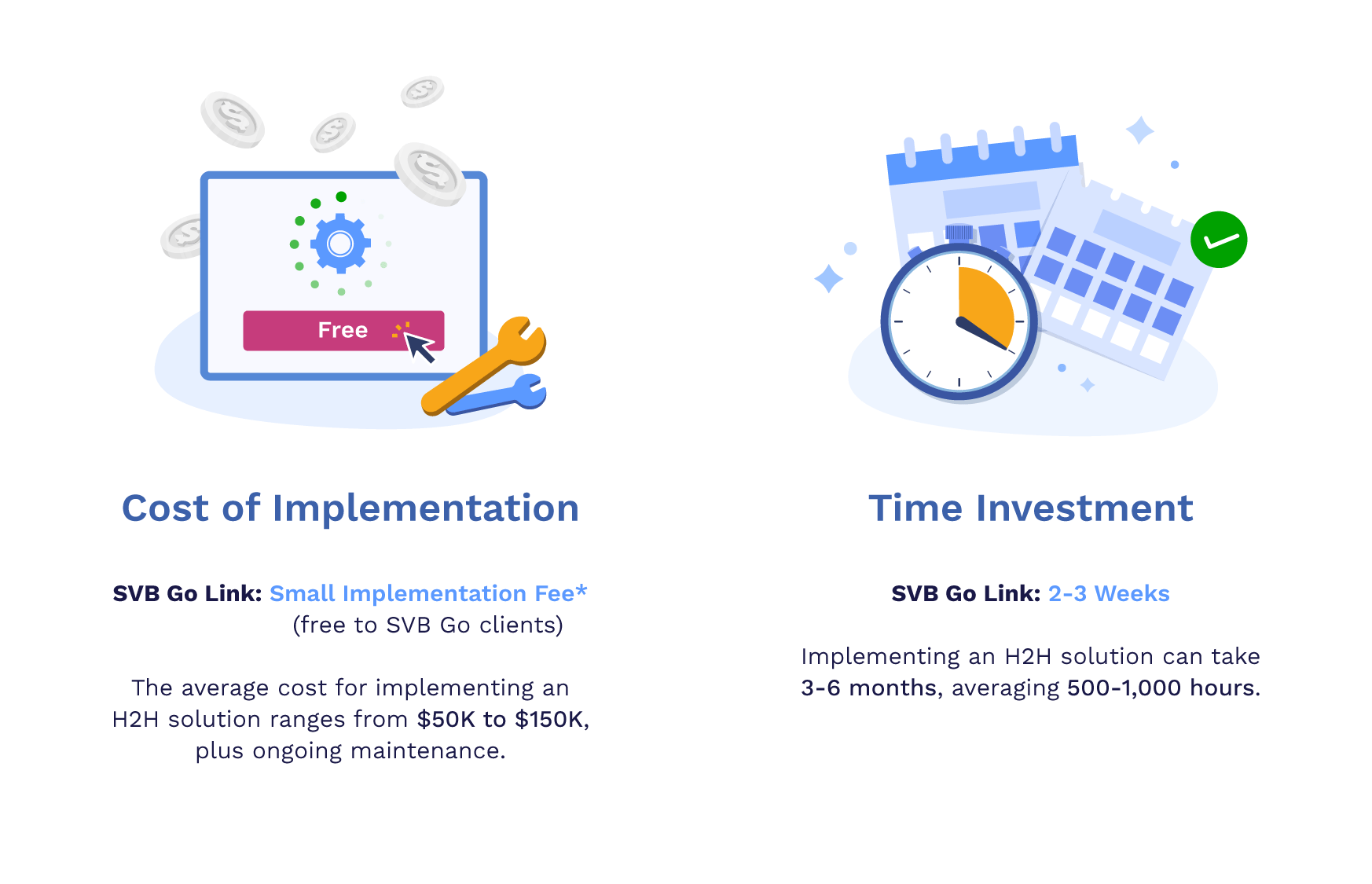

As customers mature in their payment processes, they require an integrated solution for their AP systems. While all banks often provide Host-to-Host connectivity connectors, these can present technical challenges. Clients unfamiliar with their ERP software might need to hire expensive consultants or development staff to get started. Additionally, maintaining this setup can also incur significant costs.

FISPAN helps customers save time and money by providing SVB Go Link, an out-of-the-box, downloadable plugin that can be setup in minutes, not months.

“The capability of just downloading a plugin makes that barrier to automation almost disappear. [...] It increases loyalty to the bank because of this easy integration between our two organizations.” - Savit Pirl

Lisa: So to summarize, fast-growing companies that are maturing in their finance practices need bank integrations, but they don't want to divert their software developers from product development to servicing back-office needs [...].

Would you say SVB Go Link serves as an example of innovation to increase client satisfaction? Is it a service that banks have to offer to meet client demand? Or is it primarily a component of your new client growth strategy? If you had to pick one?

Savit: (Laughs) That's tough! Honestly, it's a combination of factors. The specific customer verticals we serve at SVB-life sciences, communications and tech companies-are at the cutting edge of innovation. They are pushing the boundaries of technology for their clients, and they expect the same level of service and innovation from their partners.

So we embarked on a comprehensive journey to rebuild our digital offerings from top to bottom to really deserve the name Silicon Valley and that’s the genesis of SVB Go Link. It’s part of our new and holistic digital solution, focusing on the client first and on banking second.

If we think of money movements, we like to look beyond the transaction. If a customer needs to make a payment to someone in India, what happens before that in their lifecycle? There is a bill in their system that triggers the need for the payment, and afterward, there would be a need to reconcile books and notify the recipient in India.

Link is designed to be a critical part of this process. It integrates with our clients' back-office systems, helping them transform invoices into payments and reconcile their books at the end. If an issue arises, Link can automatically recognize it and reopen the invoice for the customer to address.

Lisa: As a bank that built its reputation as “the go-to” for innovative companies, you’ve created your offering based on digital capabilities more than traditional banking services - indeed, over the past years, your clients typically had all the capital they needed thanks to flowing VC funding.

In that context, these companies tend to value digital capabilities and APIs more than traditional banking services like revolving lines, accounts payable/accounts receivable (AP/AR) management or cash management optimization advice.

However, the financial environment seems to be shifting for these very kinds of companies today. Are you seeing a trend within your portfolio where clients are now more interested in traditional banking services, and is SVB Go Link a part of this?

Savit: Absolutely, our customers are increasingly asking for better financial visibility. The economy has retrenched, and the ease of access to capital that existed for some before has lessened, though it hasn't dried up completely. Many venture capitalists are currently slowing their investment pace, leading fast-growing companies to tighten their belts. Many of those who were hoping for Series B or C funding are now more focused on cash management and understanding what their burn rate is.

“Companies are also keen to manage their accounts receivable effectively to become cash flow positive. The notion that more money will come in or that another firm will acquire them is becoming increasingly less realistic.” - Savit Pirl

But this increased need for financial visibility is driving our clients to use tools like SVB Go Link. They're working more closely with their treasury and finance staff to get a better grasp of their financial standing. And as a consequence, we’ve seen sales of this product start picking up momentum more and more.

Lisa: As a fast-growing company ourselves, we know that connecting all departments and providing real-time financial data is essential for optimal performance, and we see similar trends with our clients.

Now back to our product, when it comes to features that are most valued by clients, I noticed that it's often the simpler, more functional aspects that get the most appreciation.

For example, simple cash positioning—being able to see their ERP book balances and bank balances on the same screen in real-time—is a game-changer for many. While many businesses invest in sophisticated cash forecasting tools, the immediate need is often just to know the cash position for the next day. This real-time insight is invaluable.

Other features clients often value are things we, as software developers, might consider afterthoughts, like inter-account transfers within the ERP system. On the surface, it may appear as mere keystroke savings, but statistics indicate that 15 to 20% of such transfers where businesses mirror them in their Bank Portal and ERP result in errors. So, the simple act of centralizing this function can prevent these mistakes.

Looking forward, will SVB continue to focus on offering rock-solid payment services or will you also be focusing on providing value-added data services for cash management, by leveraging data from client ERPs?

Savit: Our approach at SVB is actually a blend of both strategies. As we mentioned, SVB has undergone a digital transformation in recent years, and one popular feature on our new website is a widget that displays the client's "burn down rate": essentially showing how long they can continue to operate with their current funds. This is particularly useful for our clients in the innovation economy who may not be financial experts.

However, the data we use for this is what we see going in and out of the customer's account and would not be a perfect reflection of reality. That’s why we're actively exploring how to extend that, and SVB Go Link, being connected with the ERP could be a great asset to go deeper in the data and help us provide better insights to the clients.

With our position in the banking ecosystem, we occupy a unique niche, serving the vanguard of innovation and forward-thinking talent. This provides us with an unparalleled opportunity to establish synergistic partnerships with our own client base, many of whom are also providers of cutting-edge services and solutions.

We don't subscribe to the notion that we must develop every capability in-house. In fact, we recognize that our diverse client portfolio is a wellspring of valuable, industry-leading offerings.

In summary, while we are dedicated to offer a comprehensive suite of robust payment solutions, we also want to provide value-added data services. And to augment and enhance these offerings, we're proactively pursuing partnerships with those who share our vision for innovation.

Lisa: As a Bank Tech company founder, I totally recognize that SVB’s reputation in the industry is your historical openness to piloting new things and being amongst the earliest adopters of your client’s innovations, and certainly the partnership with FISPAN is an example of this. I believe we are only in the early days of the story we can write together for SVB’s clients and ourselves.

But given the bank's current position and what you have gone through in the recent months, is there going to be a shift in this practice into a more conservative, “Back to Basics” era? What can we expect and what message would you like to send to the bank tech community?

Savit: The key message we want to convey, especially now under the ownership of First Citizens, is unequivocal: Silicon Valley Bank isn't going anywhere. We're here today, and we'll be here tomorrow to serve you. With a new parent company, it's natural to wonder what will change and what will remain constant. Over these past months, First Citizens has deeply examined our operations and has come to value the culture we've nurtured at SVB—our customer-centric focus and our continual product development. Simply put, they love where we are and what we're doing, which aligns with their own aspirations.

So, for our customers, rest assured that our suite of products and services will continue to be available. We're not taking our foot off the gas; we remain committed to innovation. Partnering with our clients is ingrained in our ethos. Now, with a broader platform, we're exploring ways to leverage our expertise with First Citizens. We remain fully open to new opportunities and partnerships.

Lisa: This makes you an even more exciting partner!

In conclusion, I'd like to revisit one of my initial experiences as the CEO of FISPAN. When we were first starting out, I was personally pitching our product to prospective clients. Our early adopters were generally younger tech companies led by CFOs and treasurers who had different expectations than more “traditional old school” businesses, which might still rely on checks or on-premises SWIFT nodes for international payments. These forward-thinking clients were looking for cloud-based accounting, straight-through processing, and APIs from their banking partners.

Fast forward to today, and we're observing a notable shift. The 'historically traditional' companies are now migrating to cloud-based solutions as their legacy, on-premises systems reach end-of-life. We're also seeing a generational change in personnel that aligns their expectations more closely with those of newer, more innovative companies.

Given this landscape, do you perceive opportunities for innovative solutions like SVB Go Link, FISPAN, or others to gain wider adoption within First Citizens' existing customer base? Or do you envision these platforms taking separate trajectories within the two organizations?

Savit: While I will not comment on the strategic direction of SVB and First Citizens, it's clear from broader market trends that modern companies are increasingly leaning toward connectivity and API technologies over traditional file and batch-based systems. This presents a significant opportunity for FISPAN and other fintechs. In this group, we have even created a specialized "Embedded Banking" division. We see ourselves as the wizard behind the curtain that powers fintech solutions, particularly in areas like bill payments. While fintechs may offer excellent user interfaces for managing bills or invoices, the transactions themselves still need to be executed. That's where our synergetic role as a bank comes into play.

To your point about connectivity, not every organization is interested in building their own links to SWIFT or the Federal Reserve. That's why we offer API-driven, embedded solutions that allow fintechs to power their products and execute transactions seamlessly. This is an integral part of what we bring to the table.

To tie it all together, we view SVB Go Link as a complementary asset in an overall API and file data exchange strategy. A fintech company could leverage our APIs or host-to-host solutions for its customer-facing services, while utilizing SVB Go Link for its corporate B2B and cash management needs. We don’t see SVB Go Link as an either-or proposition. Instead, it's a versatile component that can work in tandem with other real-time, host-to-host, or high-volume solutions.

In essence, we see it as a flexible tool catering to a diverse range of client needs, and we're excited about its potential moving forward.